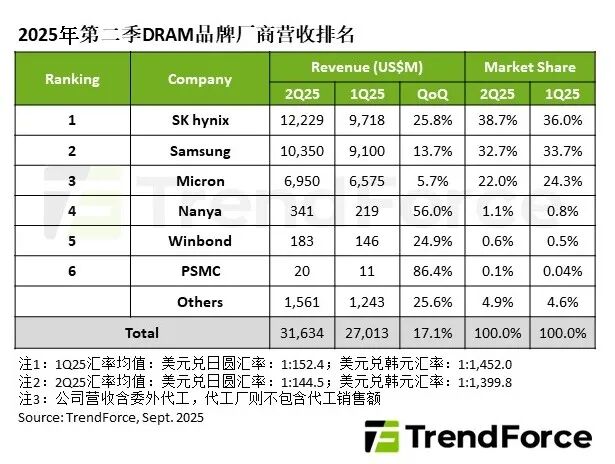

智通财经APP获悉,TrendForce集邦咨询表示,2025年第二季DRAM产业因一般型DRAM (Conventional DRAM)合约价上涨、出货量显著增长,加上HBM出货规模扩张,整体营收为316.3亿美元,季增17.1%。平均销售单价(ASP)随着PC OEM、智能手机、CSP业者的采购动能增温,加速DRAM原厂库存去化,多数产品的合约价也因此止跌翻涨。

观察主要供应商第二季营收表现,SK hynix(SK海力士)位元出货量优于目标计划,但因相对低价的DDR4出货比重提升,抑制整体ASP成长幅度,营收接近122.3亿美元,季增达25.8%,市占上升至38.7%,蝉联第一名。

排名第二的Samsung(三星),第二季在售价、位元出货量皆小幅增加的情况下,营收成长13.7%,达103.5亿美元,市占微幅下滑至32.7%。Micron(美光)的出货量明显季增,ASP则因DDR4出货比重增加而季减,营收为69.5亿美元,季增5.7%,市占下降至22%,排名第三。

南亚科、华邦电子与力积电第二季营收皆大幅成长,主因是其成熟制程产品逐步衔接上前三大业者转换制程后无法满足的市场。其中,Nanya(南亚科)得益于PC OEM和Consumer大客户积极补货,第二季出货量大幅季增,与ASP下跌的效应抵消后,营收仍强劲成长56%,上升至3.4亿美元左右。

Winbond(华邦电子)出货量也明显季增,在ASP持平的情况下,第二季营收季增24.9%,来到1.8亿美元。PSMC(力积电)的营收计算主要是自身生产的Consumer DRAM产品,不包含DRAM代工业务,在客户积极补货下,其营收季增达86.4%,成长至2,000万美元。若加计代工部分,因客户采购动能回温,PSMC营收季减幅度收敛至2.9%。