The Campbell’s Company (NASDAQ:CPB) posted better-than-expected earnings for the fourth quarter on Wednesday.

The company reported fourth-quarter sales growth of 1% year-over-year (Y/Y) to $2.32 billion, slightly missing the analyst consensus estimate of $2.33 billion. Adjusted EPS of 62 cents beat the consensus estimate of 56 cents.

Campbell expects full-year sales between $10.035 billion and $10.240 billion, representing a decline of 2% to flat growth. The company projects adjusted EBIT to fall 9% to 13%, with adjusted earnings per share forecast in the range of $2.40 to $2.55.

Campbell's CEO Mick Beekhuizen said, "Meals & Beverages benefited from the continued strong in-market performance of our leadership brands, outpacing category growth as consumers continued to cook at home."

Campbell’s shares fell 2.5% to trade at $32.89 on Thursday.

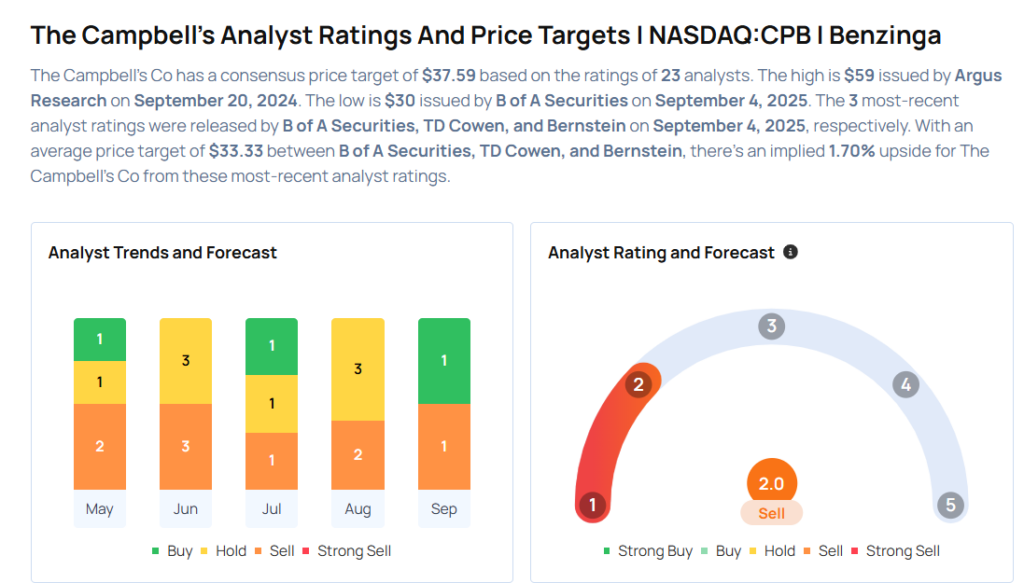

These analysts made changes to their price targets on Campbell’s following earnings announcement.

- Bernstein analyst Alexia Howard maintained Campbell’s with an Outperform rating and raised the price target from $38 to $39.

- TD Cowen analyst Robert Moskow maintained the stock with a Hold and raised the price target from $29 to $31.

- B of A Securities analyst Peter Galbo maintained Campbell’s with an Underperform rating and raised the price target from $29 to $30.

Considering buying CPB stock? Here’s what analysts think:

Read This Next:

- Wall Street’s Most Accurate Analysts Give Their Take On 3 Financial Stocks With Over 11% Dividend Yields

Photo via Shutterstock