热点栏目

客户端

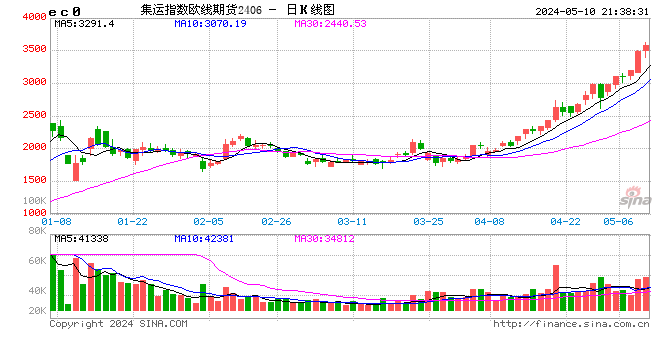

9月19日收盘,国内期货主力合约涨跌互现。集运欧线跌超6%,PX0>对二甲苯(PX)、PTA跌超2%;上涨方面,工业硅涨超3%,菜粕跌超2%,碳酸锂、烧碱、焦煤、菜油跌超1%。

光大期货分析师认为,对于对二甲苯(PX)此轮下跌,从影响因素来看,近两日原油价格出现明显下行,PX成本侧向下坍塌。本周EIA数据显示美国柴油表需延续回落,考虑到旺季需求接近尾声,美国需求仍有走软迹象。同时,美联储降息符合市场预期但鲍威尔发言偏鹰,美元走强压制风险资产走势。OPEC+已完成220万桶/日的复产计划,未来166万桶/日灵活配置产能复产启动,供给端仍有增量预期。因此,虽然地缘冲突因素阶段性扰动市场,但影响有限,原油或重新回到弱基本面交易当中,对于下游芳烃端的成本支撑有所弱化。

新浪合作大平台期货开户 安全快捷有保障

![]()

责任编辑:朱赫楠

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.