Cintas Corporation (NASDAQ:CTAS) will release earnings for the first quarter, before the opening bell on Wednesday, Sept. 24.

Analysts expect the Cincinnati, Ohio-based company to report quarterly earnings at $1.2 per share. That's up from $1.1 per share in the year-ago period. Cintas quarterly revenue of $2.7 billion, compared to $2.5 billion a year earlier, according to data from Benzinga Pro.

On July 29, Cintas increased its quarterly cash dividend from 39 cents to 45 cents.

Cintas shares fell 0.2% to close at $199.51 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

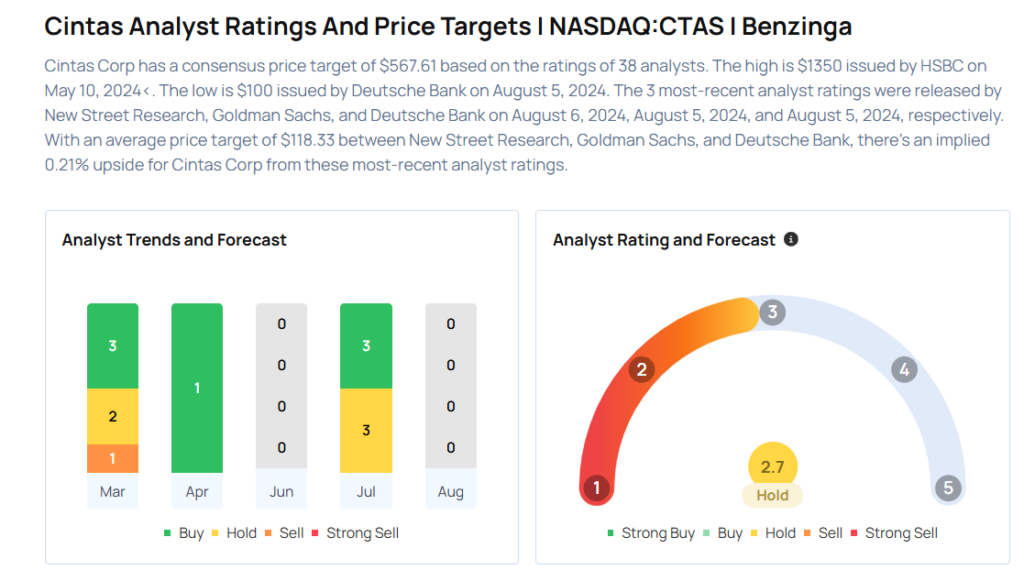

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- RBC Capital analyst Ashish Sabadra reiterated a Sector Perform rating with a price target of $240 on Aug. 21, 2025. This analyst has an accuracy rate of 75%.

- Baird analyst Andrew Wittmann maintained a Neutral rating and increased the price target from $227 to $230 on July 18, 2025. This analyst has an accuracy rate of 78%.

- Morgan Stanley analyst Toni Kaplan maintained an Equal-Weight rating and boosted the price target from $213 to $220 on July 18, 2025. This analyst has an accuracy rate of 65%.

- JP Morgan analyst Andrew Steinerman reinstated an Overweight rating with a price target of $239 on July 14, 2025. This analyst has an accuracy rate of 77%.

- Wells Fargo analyst Jason Haas upgraded the stock from Underweight to Equal-Weight and raised the price target from $196 to $221 on July 1, 2025. This analyst has an accuracy rate of 67%

Considering buying CTAS stock? Here’s what analysts think:

Read This Next:

- Cramer Backs Rubrik, Snubs Seagate’s Rally

Photo via Shutterstock