Archrock Inc. (NYSE:AROC), a key player in natural gas compression services and a vital supplier to energy giants like Exxon Mobil Corp. (NYSE:XOM) and Chevron Corp. (NYSE:CVX), is riding a wave of momentum as it joins the top 10% of stocks in growth rankings.

Archrock’s Growth Rises To The Top Decline In Rankings

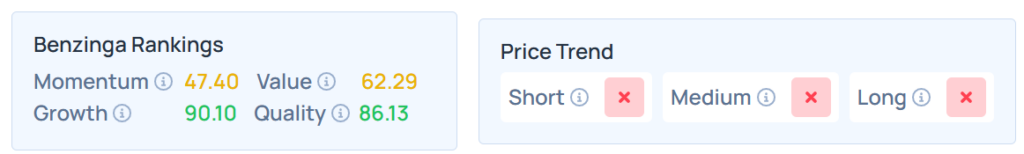

According to the Benzinga Edge’s Stock Rankings‘ growth percentile report, Archrock’s growth score rose to 90.10 from 89.99 the previous week—a modest 0.10-point delta that catapults it into elite territory among peers.

This milestone underscores the company’s accelerating revenue and earnings expansion, a metric that blends long-term trends with recent performance to highlight sustainable business scaling.

Bullish Natural Gas Market Outlook Supports AROC’s Growth

Archrock’s ascent aligns with a bullish natural gas market outlook. The U.S. Energy Information Administration’s Short-Term Energy Outlook forecasts Henry Hub prices climbing to $4.10 per million British thermal units by January 2026, driven by over 5 Bcf/d of new LNG export capacity in 2025.

As demand surges from Appalachia, Permian, and Haynesville basins, Archrock’s contract operations—boasting a 70% adjusted gross margin in the second quarter of 2025—position it to capture midstream infrastructure growth.

The firm recently sold 155 compressors to Flowco Holdings Inc. (NYSE:FLOC) for $71 million, optimizing its portfolio, and raised FY25 adjusted EBITDA guidance to $810–$850 million after strong second quarter results.

See Also: These 3 Beaten-Down Oil Stocks Could Make A Big Comeback

What Do AROC’s Other Rankings Say?

Benzinga rankings paint a robust picture for AROC. Apart from its growth score at the 90.10th percentile, its quality clocks in at 86.13, reflecting solid operational efficiency and financial health relative to peers. Its value ranking at the 62.29th percentile, suggests undervaluation based on assets, earnings, and sales comparisons.

Additional performance details are available here.

Price Action

Archrock shares were 0.82% higher in premarket on Thursday. It ended 0.50% higher at $24.30 per share on Wednesday. The stock was down 3.99% year-to-date but advanced 13.18% over the year.

The S&P 500 index ended 0.40% higher at 6,671.06 on Wednesday, whereas the Nasdaq 100 index advanced 0.68% to 24,745.36. On the other hand, Dow Jones fell 0.037% to 46,253.31.

On Thursday, the futures of the S&P 500, Dow Jones, and Nasdaq 100 indices were trading higher.

Read Next:

- Forget MSTR, These 3 Bitcoin-Linked Stocks Are Flashing Valuation Red Flags

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock