Danaher Corporation (NYSE:DHR) reported better-than-expected third-quarter financial results on Tuesday.

Danaher announced third-quarter adjusted earnings of $1.89 per share, which beat the analyst consensus estimate of $1.72 per share by 9.82%. For comparison, the company reported earnings of 1.71 per share in the same quarter last year.

Danaher reported $6.05 billion in quarterly revenue, beating analyst expectations of $6.01 billion.

"We are encouraged by our third quarter results," said Rainer Blair, president and CEO. "DBS-driven execution paired with continued momentum in our bioprocessing business and better-than-anticipated respiratory revenue at Cepheid enabled us to exceed our revenue, earnings and cash flow expectations."

Looking forward, the company maintained its full-year 2025 adjusted earnings guidance of $7.70 to $7.80 per share, versus estimates of $7.78 per share. Danaher also expects core revenue growth to land in the low-single digits for full-year 2025.

Danaher shares fell 0.4% to trade at $219.87 on Wednesday.

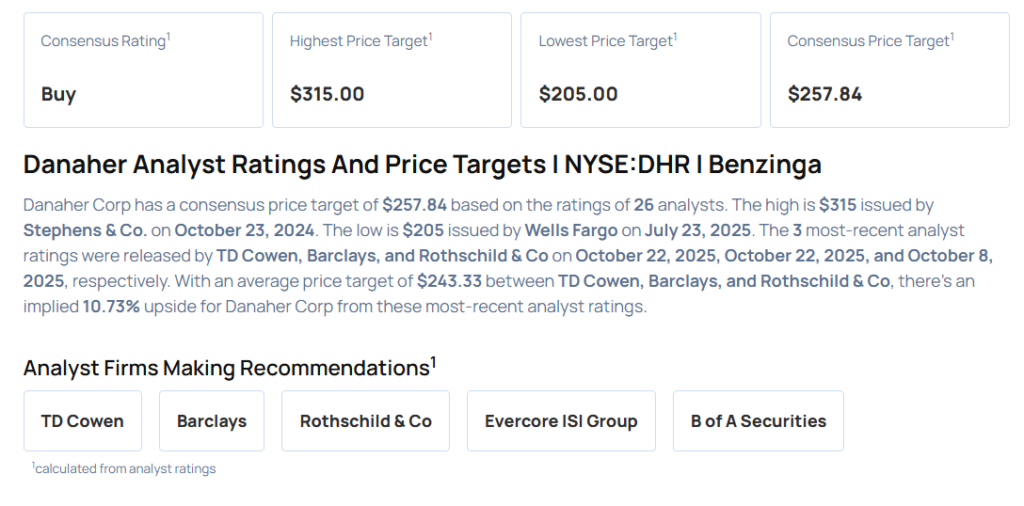

These analysts made changes to their price targets on Danaher following earnings announcement.

- Barclays analyst Luke Sergott maintained Danaher with an Overweight rating and raised the price target from $225 to $250.

- TD Cowen analyst Dan Brennan maintained the stock with a Buy and raised the price target from $250 to $260.

Considering buying DHR stock? Here’s what analysts think:

Read This Next:

- Top 2 Materials Stocks That Are Ticking Portfolio Bombs

Photo via Shutterstock