Amkor Technology Inc (NASDAQ:AMKR) reported upbeat earnings for the third quarter on Monday.

The company posted quarterly earnings of 51 cents per share which beat the analyst consensus estimate of 42 cents per share. The company reported quarterly sales of $1.987 billion which beat the analyst consensus estimate of $1.932 billion.

Amkor Tech said it sees fourth-quarter GAAP EPS $0.38-$0.48 and sales of $1.775 billion-$1.875 billion.

“Amkor delivered third quarter revenue of $1.99 billion, a 31% sequential increase, fueled by demand for Advanced packaging, which set a new revenue record,” said Giel Rutten, Amkor’s president and chief executive officer. “This quarter, we executed steep production ramps, achieved record revenue in our Communications and Computing end markets, and broke ground on our new Advanced packaging and test campus in Arizona, reinforcing our commitment to enable our customers’ technology roadmaps and strengthen U.S. semiconductor manufacturing.”

Amkor Tech shares fell 3.4% to $32.06 on Tuesday.

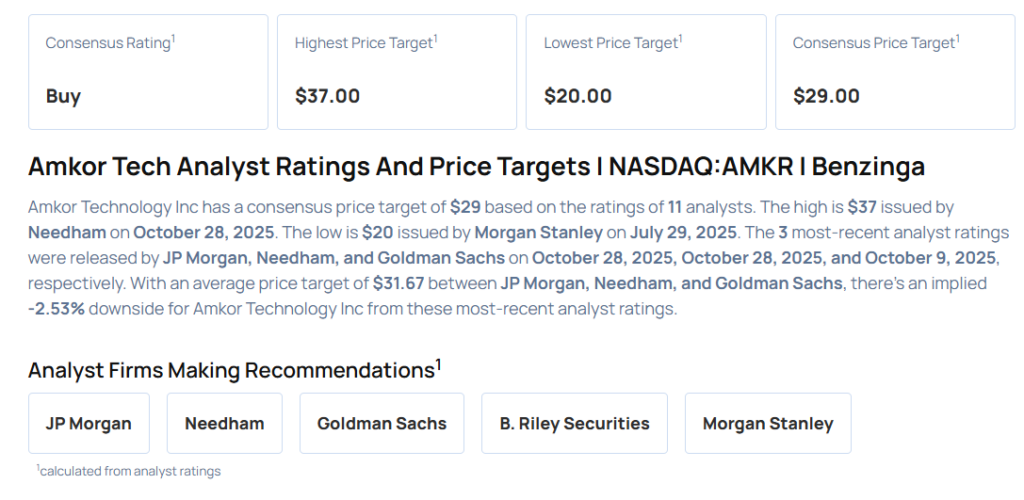

These analysts made changes to their price targets on Amkor Tech following earnings announcement.

- Needham analyst Charles Shi maintained the stock with a Buy and raised the price target from $32 to $37.

- JP Morgan analyst Peter Peng maintained Amkor Tech with an Overweight rating and boosted the price target from $27 to $32.

Considering buying AMKR stock? Here’s what analysts think:

Read This Next:

- How To Earn $500 A Month From Visa Stock Ahead Of Q4 Earnings

Photo via Shutterstock