Array Technologies, Inc. (NASDAQ:ARRY) shares climbed 9.13% in pre-market trading to $9.08 on Thursday.

Check out the current price of ARRY stock here.

According to Benzinga Pro data, the stock closed on Wednesday at $8.32, up 7.63%.

Third Quarter Financial Results

The New Mexico-based company reported revenue of $393.5 million for the quarter ended Sept. 30, up 70% from a year earlier, according to its earnings release.

Array Technologies saw a 74% increase in volume and a 65% increase in revenue so far this year.

APA Solar, acquired in August, contributed $16.9 million to revenue. Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) totaled $72.2 million, marking the company's second-highest quarterly result. Adjusted net income per diluted share was $0.30.

See Also: Why Are The Honest Company (HNST) Shares Trending Overnight?

Updated 2025 Guidance

With roughly $50 million from APA Solar, Array Technologies increased its full-year 2025 revenue projection to $1.25 billion to $1.28 billion. The range of adjusted EBITDA guidance is $185 million to $195 million.

Order Backlog

The company reported total executed contracts and awarded orders of $1.9 billion as of Sept. 30, excluding APA Solar.

Stock Performance

Array Technologies' stock is up 37.8% year to date. Its 52-week range is $3.76 to $10.37, with an intraday market capitalization of $1.27 billion.

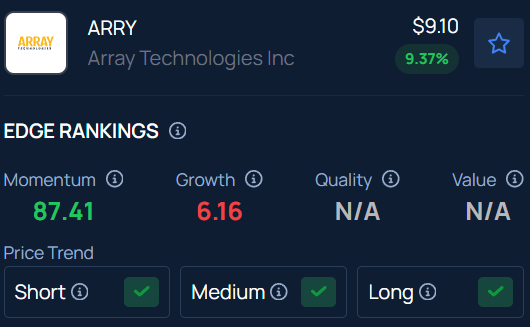

Benzinga Edge Stock Rankings indicate that ARRY has a positive price trend across all time frames. Track the performance of other players in this segment.

Read Next:

- Forge Global Stock Rockets 53% After Hours On Charles Schwab Buyout Buzz

Photo Courtesy: Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.