HubSpot Inc. (NYSE:HUBS) posted better-than-expected fiscal third-quarter 2025 results on Wednesday.

The company reported revenue of $809.5 million, a 21% increase year-over-year (Y/Y), surpassing the consensus estimate of $786.5 million. Adjusted EPS came in at $2.66, topping the Street consensus of $2.58.

HubSpot CEO Yamini Rangan said, "Customer Agent and Prospecting Agent are delivering results, while our embedded AI features are helping teams work smarter. A highlight of Q3 was our annual INBOUND conference, where we released over 200 new product innovations and launched the Loop, a new growth playbook for the AI era. Customers are turning to HubSpot to drive AI innovation, consolidate tech stacks, and reduce their total cost of ownership."

HubSpot expects fourth-quarter adjusted EPS of $2.97–$2.99 (versus consensus of $2.97) and revenue of $828 million–$830 million, versus $824.6 million consensus.

The company raised its fiscal 2025 guidance for adjusted EPS to $9.60–$9.62 (from $9.47–$9.53) versus the estimate of $9.50 and revenue of $3.113 billion–$3.115 billion (up from $3.080 billion–$3.088 billion) compared to the Street view of $3.087 billion.

HubSpot shares fell 13.3% to $403.00 in pre-market trading.

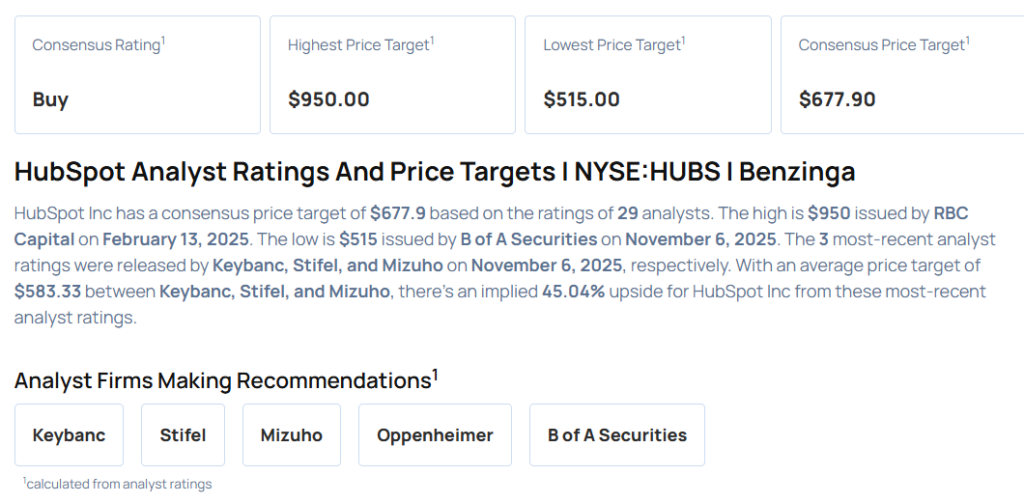

These analysts made changes to their price targets on HubSpot following earnings announcement.

- Piper Sandler analyst Hannah Rudoff maintained HubSpot with an Overweight rating and lowered the price target from $675 to $590.

- Needham analyst Joshua Reilly maintained the stock with a Buy and lowered the price target from $900 to $700.

- B of A Securities analyst Brad Sills maintained HubSpot with a Buy and cut the price target from $640 to $515.

- Oppenheimer analyst Ken Wong maintained the stock with an Outperform rating and lowered the price target from $750 to $550.

- Mizuho analyst Siti Panigrahi maintained HubSpot with an Outperform rating and lowered the price target from $700 to $550.

- Stifel analyst Parker Lane maintained the stock with a Buy and cut the price target from $600 to $550.

- Keybanc analyst Jackson Ader maintained HubSpot with an Overweight rating and slashed the price target from $775 to $650.

Considering buying HUBS stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Says ‘Take A Pass’ On This Tech Stock, Won’t Go Near Oils

Photo via Shutterstock