Medtronic plc (NYSE:MDT) will release earnings results for the second quarter, before the opening bell on Tuesday, Nov. 18.

Analysts expect the Galway, Ireland-based company to report quarterly earnings of $1.31 per share, up from $1.26 per share in the year-ago period. The consensus estimate for Medtronic's quarterly revenue is $8.86 billion. Benzinga Pro data shows $8.4 billion in quarterly revenue a year ago.

On Oct. 8, Medtronic announced the commencement of the Embrace Gynecology investigational device exemption (IDE) U.S. clinical study to assess the safety and effectiveness of its Hugo robotic-assisted surgery (RAS) system in gynecological procedures.

Shares of Medtronic rose 0.4% to close at $96.28 on Monday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

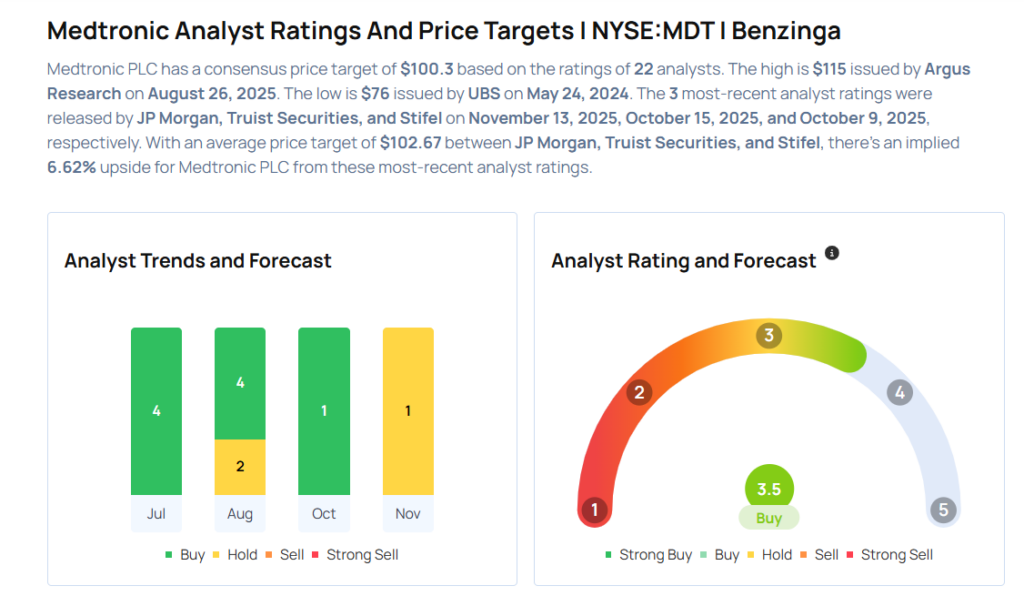

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- JP Morgan analyst Robbie Marcus maintained a Neutral rating and raised the price target from $90 to $100 on Nov. 13, 2025. This analyst has an accuracy rate of 64%.

- Truist Securities analyst Richard Newitter maintained a Hold rating and raised the price target from $96 to $103 on Oct. 15, 2025. This analyst has an accuracy rate of 71%.

- Stifel analyst Rick Wise maintained a Hold rating and raised the price target from $90 to $105 on Oct. 9, 2025. This analyst has an accuracy rate of 73%.

- Citigroup analyst Joanne Wuensch maintained a Buy rating and raised the price target from $101 to $112 on Oct. 7, 2025. This analyst has an accuracy rate of 73%.

- Argus Research analyst David Toung maintained a Buy rating and increased the price target from $105 to $115 on Aug. 26, 2025. This analyst has an accuracy rate of 68%

Considering buying MDT stock? Here’s what analysts think:

Read This Next:

- Wall Street’s Most Accurate Analysts Give Their Take On 3 Industrials Stocks With Over 7% Dividend Yields

Photo via Shutterstock