Keysight Technologies, Inc. (NYSE:KEYS) will release earnings results for its fourth quarter, after the closing bell on Monday.

Analysts expect the Santa Rosa, California-based company to report quarterly earnings at $1.83 per share, up from $1.65 per share in the year-ago period. The consensus estimate for Keysight's quarterly revenue is $1.38 billion, compared to $1.29 billion a year earlier, according to data from Benzinga Pro.

On Nov. 20, Keysight announced that the company’s board appointed Keith Jensen as a director.

Keysight shares rose 1.8% to close at $172.71 on Friday.

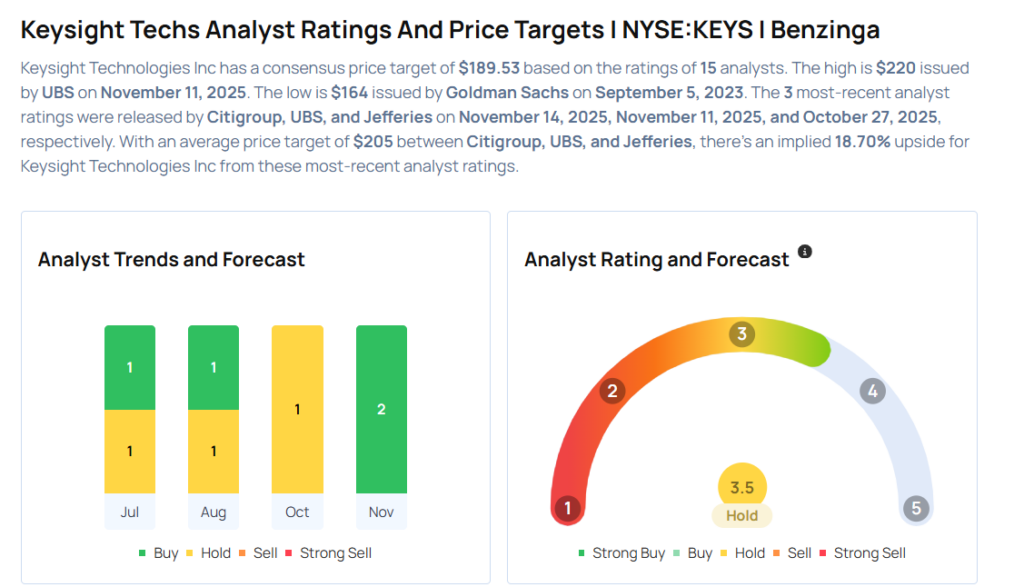

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Citigroup analyst Atif Malik reinstated Keysight with a Buy and announced a $215 price target on Nov. 14, 2025. This analyst has an accuracy rate of 83%.

- Morgan Stanley analyst Meta Marshall downgraded the stock from Overweight to Equal-Weight with a price target of $180 on Oct. 10, 2025. This analyst has an accuracy rate of 69%.

- Barclays analyst Tim Long maintained an Overweight rating and cut the price target from $200 to $195 on Aug. 20, 2025. This analyst has an accuracy rate of 70%.

- JP Morgan analyst Samik Chatterjee maintained an Overweight rating and increased the price target from $177 to $200 on July 17, 2025. This analyst has an accuracy rate of 78%.

- Baird analyst Richard Eastman maintained an Outperform rating and raised the price target from $180 to $190 on Feb. 27, 2025. This analyst has an accuracy rate of 76%.

Considering buying KEYS stock? Here’s what analysts think:

Read This Next:

- ‘No One’s Buying Homes Here’: Cramer Warns On This Housing Stock

Photo via Shutterstock