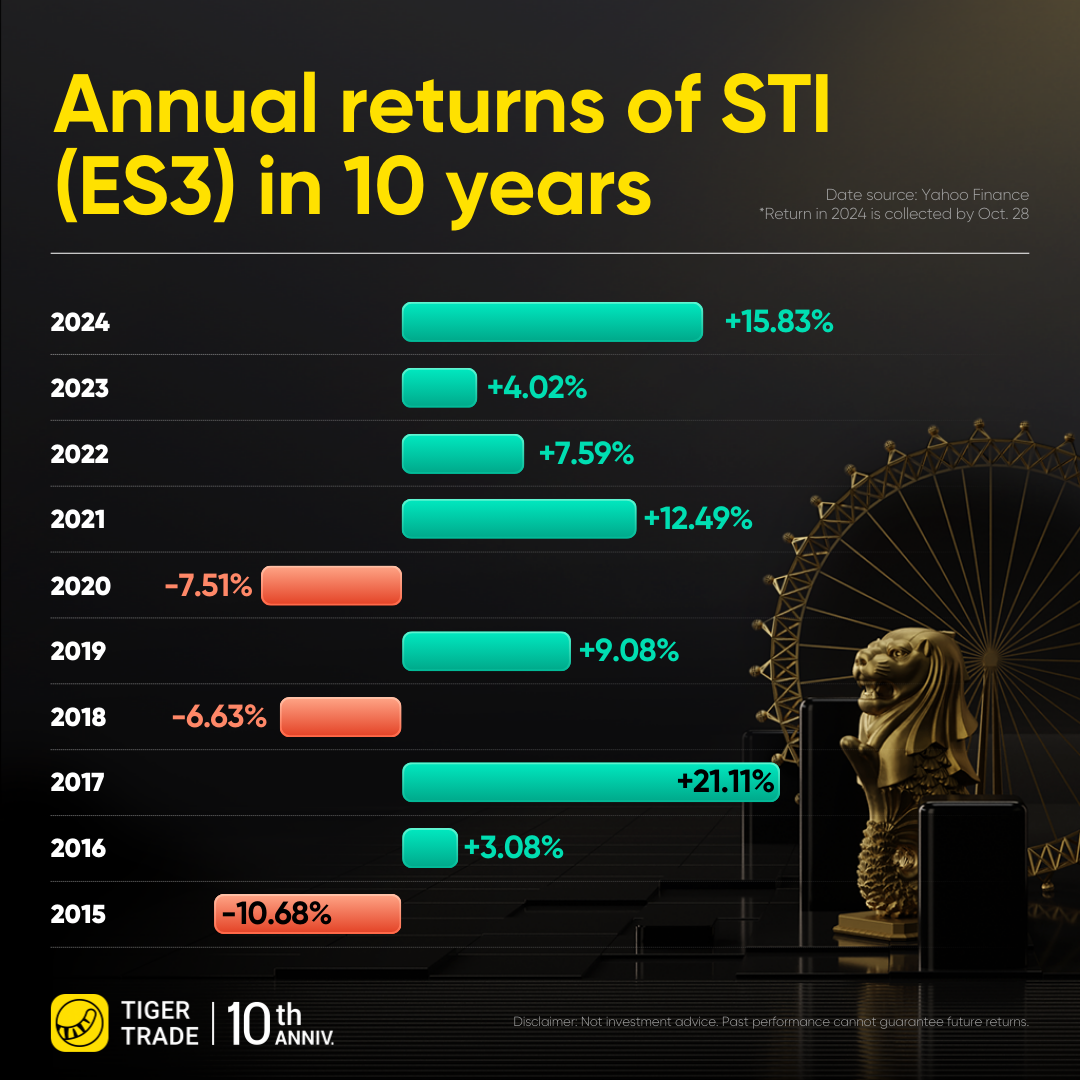

Over the past 20 years (2004-2024), the Straits Times Index (STI) has delivered total returns of 165%-221%, with an annualized return of 5%-6%. While these returns may seem modest compared to more volatile markets, Singapore's stock market is known for its stability and reliability, making it a solid option for investors seeking long-term growth.

The ETF tracking the STI (ES3) had its biggest loss in the past 10 years in 2015, with a decline of -12.9%, followed by -10.37% in 2020, and -8.87% in 2018. All other years recorded positive returns.

Why Invest in Singapore Stocks?

Familiar Companies Singapore’s market is home to well-known names like DBS Bank, CapitaLand, and Singtel—trusted companies that many locals interact with daily, making investment decisions feel more grounded.

Consistent Dividends The Straits Times Index offers a solid 3%-4% dividend yield, and without dividend taxes, you keep the full amount—great for those seeking reliable income.

Currency Stability Investing in Singapore stocks means your returns are in SGD, avoiding the complexity and risks tied to currency fluctuations in foreign markets.

Southeast Asia Growth Many Singapore-listed companies have strong footholds across Southeast Asia, allowing you to benefit from the region’s economic expansion, especially in fast-growing countries like Indonesia and Vietnam.

Why Use Tiger Trade for Singapore Stocks?

Tiger Trade offers a seamless experience for Singaporean investors, with competitive fees, real-time data, and support for advanced order types. Plus, Singaporean residents can open a contra account with Singpass, giving them access to $20,000+ limit for trading before settlement.

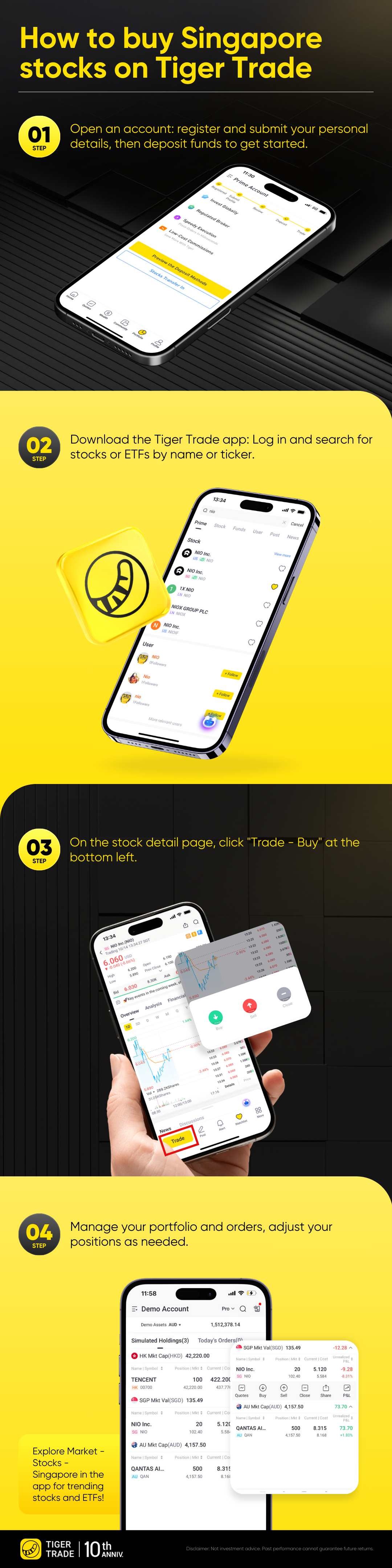

How to Buy Singapore Stocks on Tiger Trade:

Open an Account: Register and submit your personal details, then deposit funds to get started.

Download the Tiger Trade App: Log in and search for stocks or ETFs by name or ticker.

Place a Trade: On the stock’s detail page, click “Trade - Buy,” and enter the number of shares for a market order or set your desired price for a limit order.

Manage Your Portfolio: Check your holdings under "Porfolio - Orders" and adjust as needed. When ready, you can sell by selecting "Close".

Explore Market - Stocks - Singapore in the app for trending stocks and ETFs!

Disclaimer:

Investing carries risk. This is not financial advice and should not be regarded as a solicitation or recommendation of acquiring or disposing of financial products. Any content being discussed, shared, and commented does not consider your own investment objectives or financial needs. Tiger Brokers assumes no warranty or responsibility for the accuracy and completeness of the information. Past performance is no guarantee of future results. Graphics and charts are for illustrative purposes only.

This advertisement has not been reviewed by the Monetary Authority of Singapore.