NEW FUND LAUNCH

Tiger-PointNemo

Fund I

Tiger Fund Management is a holder of Capital Markets Services license (License No. CMS101343) issued by the Monetary Authority of Singapore for fund management.

For Accredited Investors (AIs) only

Under the Accredited Investor regime in Singapore, you must meet certain eligibility criteria to qualify as an Accredited Investor. You are also required to opt-in to be an Accredited Investor for your account(s) with us if you wish to be identified and treated as an Accredited Investor. Accredited investors are assumed to be better informed, and better able to access resources to protect their own interests, and therefore require less regulatory protection. Clients who agree to be treated as accredited investors therefore forgo the benefit of certain regulatory safeguards.

For example, issuers of securities are exempted from issuing a full prospectus registered with the MAS in respect of offers that are made only to accredited investors, and intermediaries are exempted from a number of business conduct requirements when dealing with accredited investors. Clients should consult a professional adviser if they do not understand any consequences of being treated as an accredited investor.

This webpage is intended for Tiger Brokers accredited investors who reside in Singapore only.

Strong Track Record

Resilience against market volatility

Quarterly Liquidity

Regular redemption windows

Monthly NAV

Stay updated with timely & transparent reporting

Diversification

Diversify to mitigate risk and enhance stability

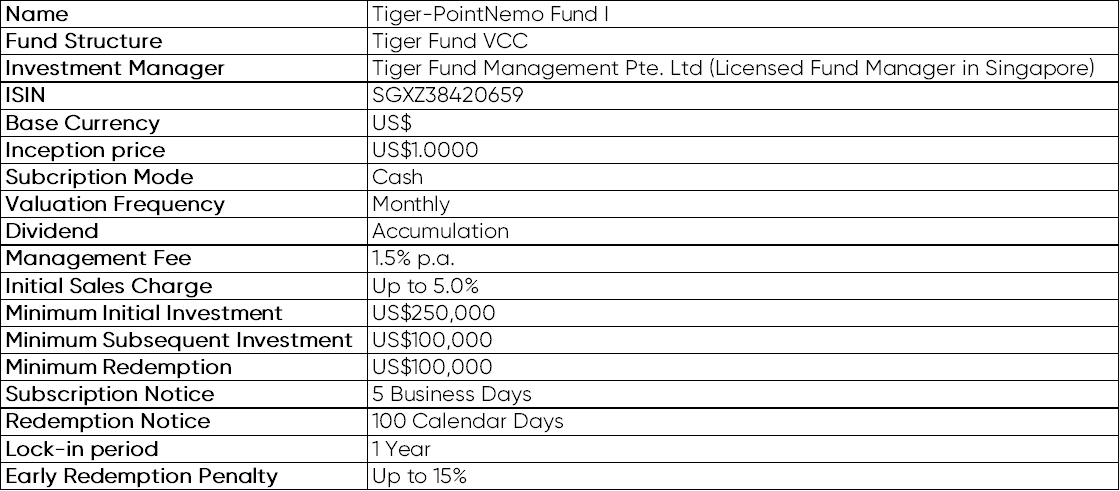

Term Sheet

This publication is for information only and your specific investment objectives, financial situation and needs are not considered here. The value of units in the Fund and any accruing income from the units may fall or rise. Any past performance, prediction or forecast is not indicative of future or likely performance. Any past payout yields and payments are not indicative of future payout yields and payments. Distributions (if any) may be declared at the absolute discretion of Tiger Fund Management Pte. Ltd. (UEN: 202223754K)(“TFMPL”) and are not guaranteed. Distribution may be declared out of income and/or capital of the Fund, in accordance with the prospectus. Where distributions (if any) are declared in accordance with the prospectus, this may result in an immediate reduction of the net asset value per unit in the Fund. Applications must be made on the application form accompanying the prospectus, which can be obtained from TFMPL or its approved distributors. You should read the prospectus and seek advice from a financial adviser before investing. If you choose not to seek advice, you should consider whether the Fund is suitable for you. The Fund may use or invest in financial derivative instruments. Please refer to the prospectus of the Fund for more information. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Connect with us:

Access funds and solutions through Tiger Fund Management, for Accredited Investors (AIs) only.