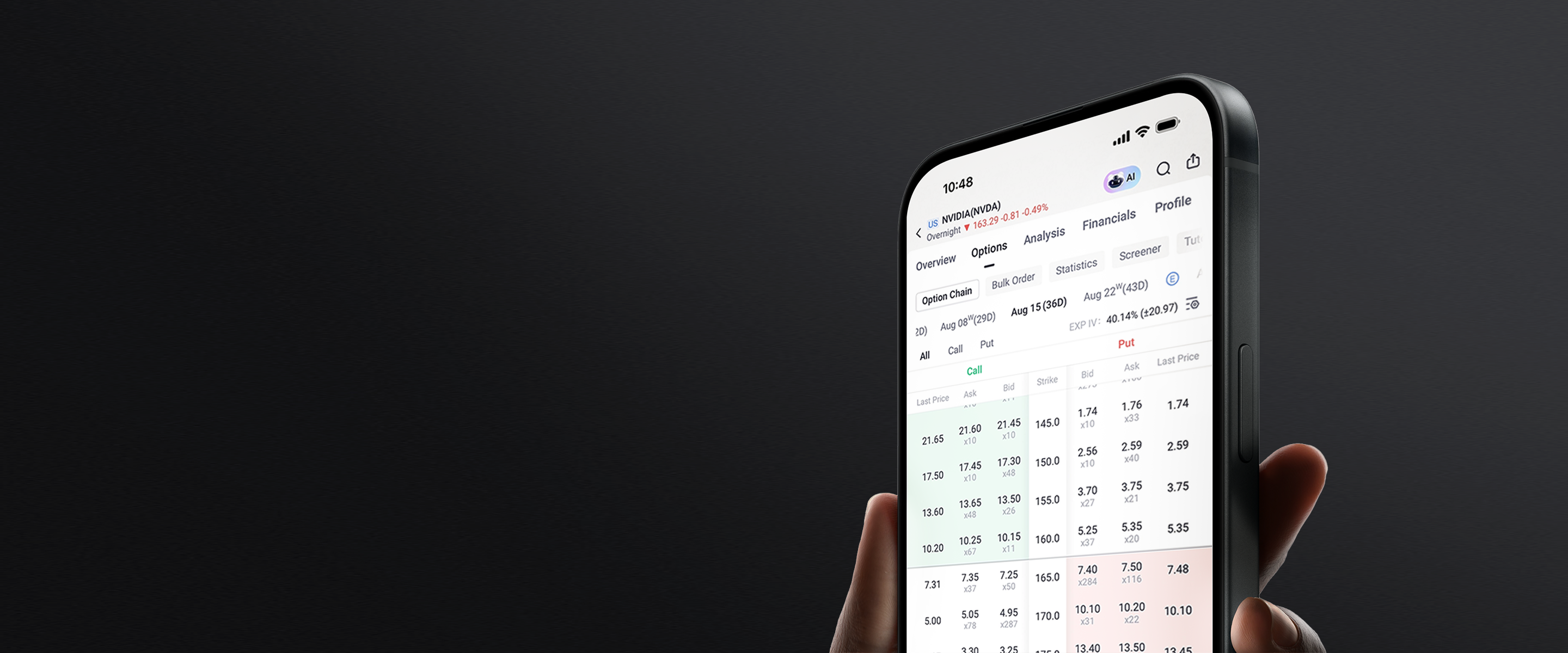

Your Options Journey Starts Here.

Start, Learn & Trade. Tiger will guide you from first trade to confidence.

*This advertisement has not been reviewed by the Monetary Authority of Singapore.

What are Options?

Options are contracts that allow buyers to buy or sell specific assets, like stocks, indices, or commodities, at a set price on a future date.

They're mainly used for risk management—protecting against market ups and downs—and speculation, where investors bet on market changes at a lower cost.

Options stand out for their leverage, which lets you control more with less money, increasing both potential gains and losses. Since trading options involves knowing the market and having a strategy, they're best suited for those with experience.

What Will You Learn Here?

Options Basics

— Build Your Foundation

Understand what options are — and how they differ from stocks.

Master the 6 key elements of an option contract.

Explore the 4 basic option trades.

Buying Options

— Maximize Gains, Minimize Risk

Learn when and why to buy CALL options instead of owning stocks.

PUT options to bet on stock declines.

Protective PUTs for insurance on your existing stock positions.

Selling Options

— Hedge, Generate Extra Income

How to set up a Covered Call strategy to generate extra income.

Use PUT selling to earn extra income, or buy the dip on your terms.

Level up your options strategies.

Join Tiger's Options Group

Get an intro to common options trading strategies and practise in DEMO account. Learn ideal market conditions for each, and how to set them up. We'll also show you what to look for when managing multiple trades.