US Treasury Bonds are debt securities issued by the US government. When you buy a Treasury Bond, you are loaning money to the government; in return, you receive periodic interest payments (coupon), and the principal returned at maturity. Compared to stocks, they are much safer, though with slower growth.

When yields on US Treasuries rise, for example into the 4 %–5 % range, they often receive renewed attention globally. Singapore investors might find them especially relevant now for reasons of income, safety, and currency diversification.

What Market Conditions Make Treasuries Attractive? (A Case Study)

While specific data changes constantly, investors typically analyze a few key indicators to determine if it's a favorable time to invest in bonds. The market conditions in late 2025 illustrate some factors worth observing:

1. Latest US Treasury yield curve

The US 10-year Treasury yield is about 4.12 % (23 Sept 2025) [1].

Shorter maturities like the 2-year note are yielding around 3.5 %–3.6 % (Sept 2025) [2].

2. US inflation trends

Consumer Price Index (CPI) rose by 2.9 % year-on-year (Aug 2025) [3].

Core inflation, excluding food and energy, remains near 3.0 % (Sept 2025 estimate) [4].

3. Fed policy update

The Federal Reserve recently cut the federal funds rate by 25 basis points, moving the target range to 4.00 %–4.25 % (17 Sept 2025) [5].

Officials indicated that future rate moves will depend heavily on data such as employment and inflation.

4. Economic context

The US job market is showing signs of cooling, while growth momentum is moderate.

Investors are balancing risks of inflation staying above target with risks of economic slowdown.

What this means for bond investors: Yields are high enough that, even after accounting for inflation, investors can earn positive real returns. However, interest rate risk and inflation risk remain important to notable.

Understanding US Treasury Securities

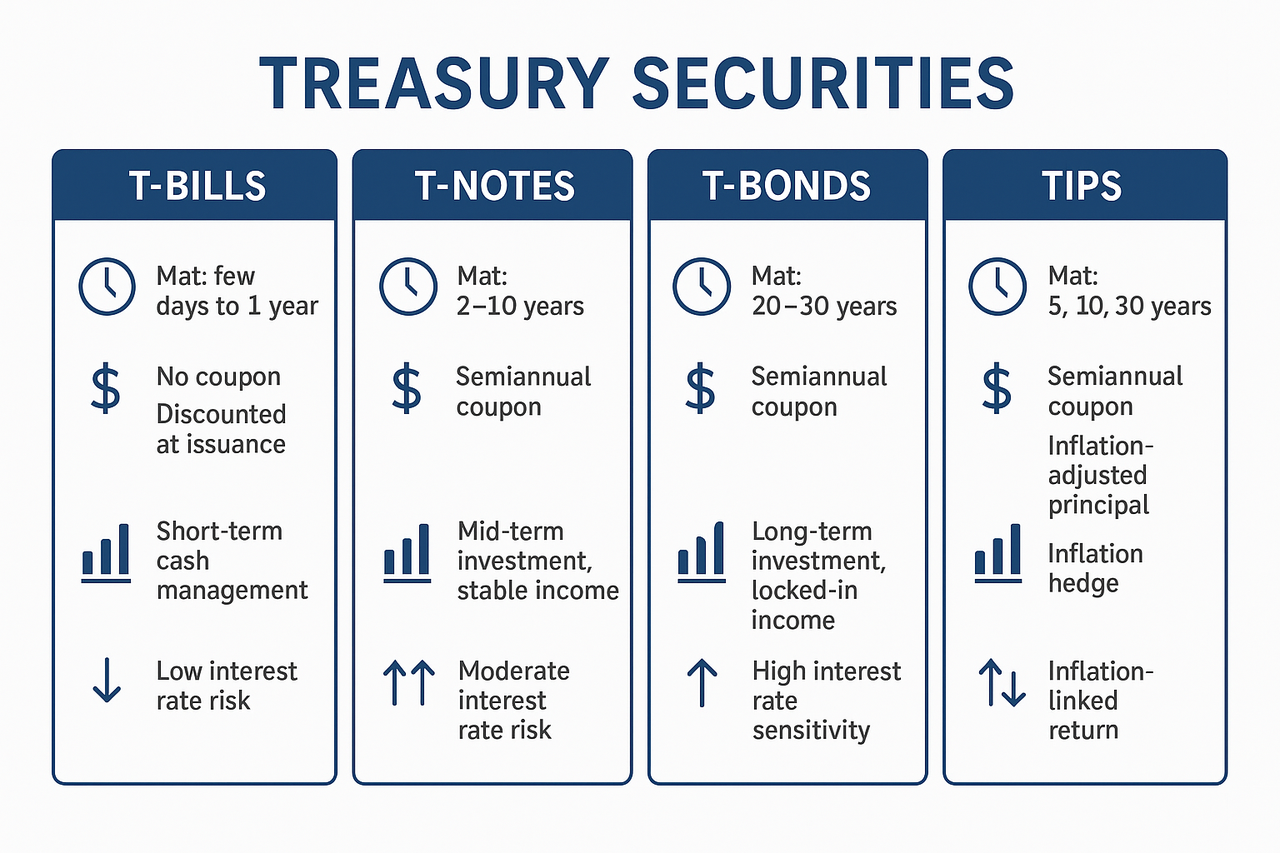

For beginners, here are the main types of Treasuries:

T-Bills: very short-term (weeks to 1 year), issued at discount, no coupon.

T-Notes: maturities of 2-10 years, pay semi-annual interest.

T-Bonds: longer maturities (20-30 years), higher yields but greater duration risk.

TIPS (Treasury Inflation-Protected Securities): principal and interest adjust with inflation.

Risk-return profile:

Default risk: essentially zero, backed by the US government.

Interest rate risk: bond prices fall if rates rise, especially for longer maturities.

Inflation risk: nominal Treasuries lose real value if inflation runs higher than expected; TIPS mitigate this.

Tax treatment: US Treasuries are generally exempt from state/local taxes for US residents; non-residents should check withholding/tax rules.

Putting it into context: With the 10-year yield at 4.12 % (Sept 2025) against inflation of 2.9 % (Aug 2025), the real yield is modestly positive. Longer maturities lock in higher coupons but carry greater sensitivity to interest rate shifts.

Why Treasuries Are Attractive to Singapore Investors

From a Singapore retail investor’s perspective, here are reasons why US Treasuries might be worth considering:

Capital preservation and safety: Treasuries are among the safest fixed income instruments globally. In volatile or uncertain markets, they act as a stabilising anchor within a portfolio.

USD income + currency diversification: Holding US Treasuries provides USD-denominated yields. This helps diversify beyond Singapore dollar assets and offers potential hedge benefits if exchange rates shift.

Inflation hedging (via TIPS): Treasury Inflation-Protected Securities (TIPS) are designed to help protect investors from inflation, but their effectiveness can vary depending on your investment timeline and method of purchase. They tend to be more valuable when inflation remains persistently above 2%.

Role in a diversified portfolio: Treasuries typically have low correlation with equities, REITs, and other risk assets, making them effective tools for reducing portfolio volatility and smoothing returns over time.

How to Invest in US Treasuries via Tiger Trade

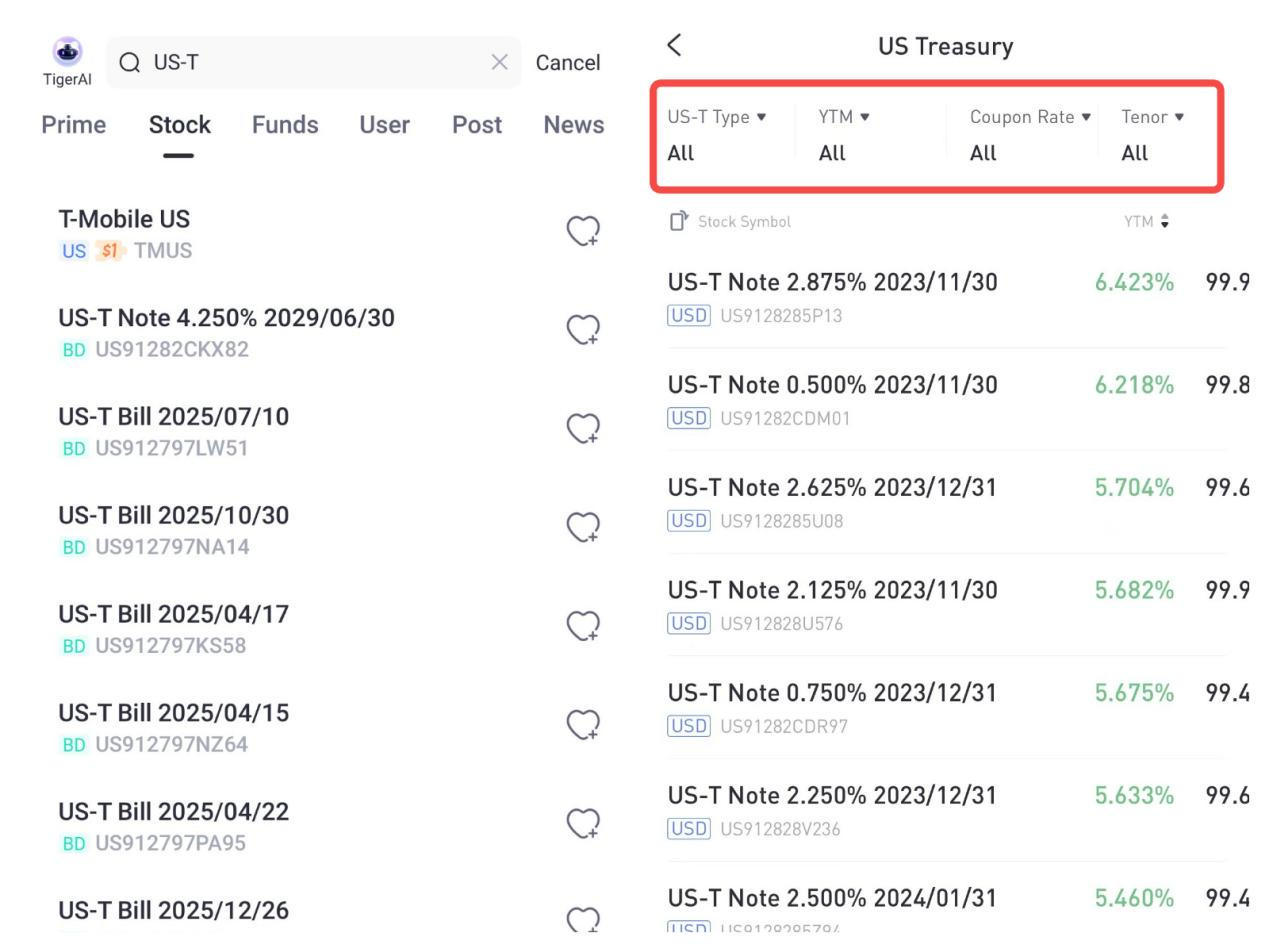

Here's how to buy US Treasury bonds on the Tiger Trade app can be done in just a few steps:

Open an account: Register through the Tiger Trade app or website (Singpass is supported). Approval usually takes 1–3 business days.

Fund your account: Deposit in SGD or USD. If you fund in SGD, you can convert to USD directly within the app.

Search for Treasuries: Enter “US-T” in the Bonds section. Use filters to sort by maturity, coupon, or yield.

Place an order: Select a bond, choose market or limit order, and enter the face value you want (in multiples of USD 1,000).

Fees: Typically 0.08% commission, 0.04% platform fee, and 0.08% custody fee (based on face value). Always check the app for the latest charges.

Conclusion

For Singaporean retail investors seeking safe income streams, inflation protection, and USD diversification, US Treasury Bonds can be a cornerstone of a portfolio. When market conditions present attractive real yields, they offer a compelling low-risk option. While risks like interest rate changes remain, they play a valuable role in building a balanced, diversified portfolio.

References

[1] https://fred.stlouisfed.org/series/DGS10

[3] https://www.usinflationcalculator.com/inflation/current-inflation-rates/

[4] https://www.clevelandfed.org/indicators-and-data/inflation-nowcasting

Disclaimer

The information expressed herein is current and does not constitute an offer, recommendation or solicitation, nor does it constitute any prediction of likely future performance. Investment involves risk. The price of investment instruments can and do fluctuate, and any individual instrument may experience upward or downward movements, and under certain circumstances may even become valueless. Past performance is not a guarantee of future results. In preparing this information, we did not take into account the investment objectives, financial situation or particular needs of any person or affiliated companies. Before making an investment decision, you should speak to a financial adviser to consider whether this information is appropriate to your needs, objectives and circumstances. Tiger Brokers assumes no fiduciary responsibility or liability for any consequences financial or otherwise arising from trading in securities if opinions and information in this document may be relied upon. This advertisement has not been reviewed by the Monetary Authority of Singapore.