Singaporeans today have no shortage of choices when it comes to building their investment portfolio. So many financial products are out there—stocks, options, equity funds, and, of course, money market funds (MMFs). But do you really understand what a money market fund is?

So, in today's article, we are going to break this concept down, seeing its definition, benefits, differences between equity funds and more, helping you understand money market funds comprehensively!

What is a money market fund?

A money market fund is a type of mutual fund that invests in short-term, high-quality debt instruments and cash equivalents. These aim to provide investors with a low risk avenue to invest easily accessible, cash-equivalent assets, typically higher yields than some other financial products.

Simply put, this kind of cash management product is like an accessible savings tool, allowing you to withdraw money at any time.

What are the opportunities and risks of money market funds?

Money market funds offer several key benefits based on their investment strategy and structure:

Opportunities

Security and Stability

Money market funds primarily invest in short-term, low-risk financial instruments like bonds from government, central bank bills, etc. These assets have high credit ratings and stability, ensuring that investors' funds are well protected.

Liquidity

Money market funds are considered "quasi-savings products", meaning investors can buy (subscribe) or sell (redeem) them at any time. Some even provide instant redemption features, allowing same-day withdrawals.

Diversification

There are various types of money market funds available, each with different underlying assets and strategies—such as those focusing on government securities, corporate papers, or bank deposits. This variety allows investors to choose products that align with their specific risk preferences and cash management needs.

Lower Minimum Investment

Unlike some traditional financial products, money market funds often have relatively low entry thresholds. This makes them accessible to a wider range of groups, including beginners looking to manage idle cash more efficiently.

No Fees for Redemption

For some money market funds, there is no charge for redemption fees, allowing investors to withdraw their money without incurring additional costs. This fee-free structure enhances flexibility and makes it easier for individuals to manage short-term liquidity needs.

Risks

Policy Influence

Money market funds could be influenced by changes in national policies, including monetary, fiscal, and industrial policies. These changes may affect the performance of money market instruments and, in turn, the returns of the fund.

Credit Risk

Although money market funds invest in relatively low-risk instruments, there is still a possibility that an issuer could default or experience a downgrade in credit rating. Such events may affect the fund's value and returns, especially if concentrated in a particular issue or sector.

Foreign Exchange Exposure

Some money market funds may invest in assets denominated in foreign currencies. For investors using a different base currency, fluctuations in exchange rates can impact the fund's net asset value, potentially leading to currency-related gains or losses.

Money market fund vs equity fund

For beginners choosing among these instruments, here’s a golden rule to distinguish them:

“ Use money market funds for short-term cash and equity funds for long-term growth.”

For details, here’s a chart for you to understand the differences more specifically:

Money Market Fund | Equity Fund | |

Investment Assets | Government bonds, bank certificates of deposit, etc. | Stocks, derivatives |

Investment Risk | Historically rare losses, but not completely risk-free | Closely correlated with market up-and-downs |

Redemption | T+0 or T+1 | Typically within T+1 to T+2 |

Money market funds typically aim for stability by investing in low-risk assets; however, their value can fluctuate daily, and returns may occasionally be negative. It's important for investors to evaluate these characteristics in the context of their own financial goals and risk tolerance.

Examples of Money Market Funds

As a beginner who is interested in MMFs, it's helpful to understand how to evaluate investment options. In Singapore, many MMFs have shown stable performance historically, but it's important to do thorough research and consider your own financial goals.

If you're new to MMFs, it’s key to learn how to evaluate your options. In Singapore, many funds have demonstrated stable performance in the past, but it's always a good idea to dive deeper and align your choices with your financial goals. Below are two examples:

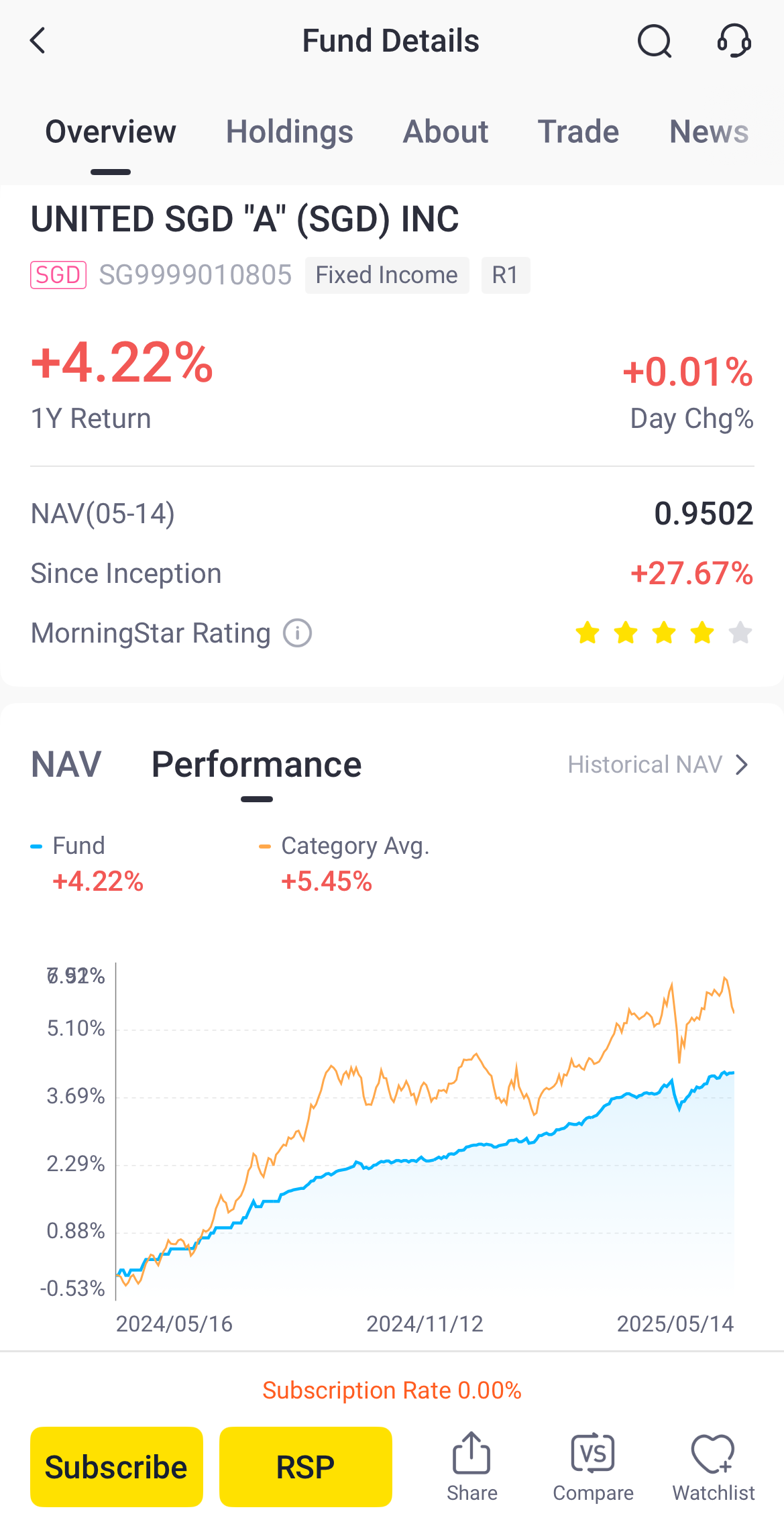

United SGD Fund

This fund is provided by UOB Asset Management, which primarily invests in short-term instruments and interest-bearing debt securities. Over the past year, its annual yield exceeded 4%*. Additionally, the fund does not charge subscription or redemption fees, which may enhance cost efficiency for investors.

Managed by one of Singapore’s largest asset management companies, Fullerton, this fund offers T+1 redemption, providing relatively quick access to funds. It is structured to maintain overall stable returns while focusing on liquidity and capital preservation*.

Fullerton SGD Cash Fund

Managed by one of Singapore’s largest asset management companies, Fullerton, this fund offers T+1 redemption, providing relatively quick access to funds. It is structured to maintain overall stable returns while focusing on liquidity and capital preservation*.

Using Tiger Trade for Investing in Money Market Funds

Investing in money market funds on Tiger Trade offers transparent brokerage fees and a seamless, user-friendly experience, making the process simple and accessible. Here’re the advantages of using Tiger Trade :

Low min. Entry from just $100

Largest variety of mutual funds

Free access to institutional fund shares classes

Easily compare funds with rankings, Morningstar ratings, and risk indicators to make informed choices.

Grow your funds over time with an automatic hands-free and regular investment plan.

Small and consistent contributions can make a big difference. Find out more on Tiger Trade to know how your idle money can grow over time through regular investment!

3 Steps to Open an Account at Tiger Brokers for MMFs

To open an account on Tiger Brokers' fund house is simple—just follow these 3 steps:

Download the Tiger Trade App – Available on iOS and Android.

Submit Your Documents – Upload your documents or use Singpass for quicker registration.

Wait for Approval – Once your application is reviewed and approved, you can start investing.

With this quick and easy process, you can open an account and begin investing in money market funds and other wealth management products on Tiger Brokers!

Reference

Available at: https://mothership.sg/2024/08/toast-box-raise-price-2024/

Available at: https://www.zaobao.com.sg/finance/singapore/story20250314-6018597

Available at: https://www.itiger.com/sg/help/detail/08384947

Available at: https://www.bankrate.com/banking/what-banks-do-with-deposits/

Available at: https://thndr.app/learn/money-market-funds-vs-equity-funds-which-one-is-for-you/

Available at: https://www.uobam.com.sg/uobam/our-funds/highlights/united-sgd-fund/index.page

Disclaimer:

*T&Cs apply. Please refer to our website at [https://www.itiger.com/sg/] for further details. Not financial advice. Capital at risk. Investing in financial market products carries the inherent risk of loss. This advertisement has not been reviewed by the Monetary Authority of Singapore.

* Past performance is not indicative of future results. Performance is subject to market volatility.