PayTo

PayTo is a secure digital payment method introduced under Australia’s New Payments Platform (NPP) and is supported by major banks in Australia.

It allows you to deposit funds directly from your bank account to Tiger account, with minimal effort. By providing a one-time consent and authorisation through your banking portal or app to set up a PayTo agreement, your future funding experience becomes seamless: for subsequent PayTo deposit, you will only need to submit the deposit instruction via Tiger Trade app and the deposit will be processed on demand automatically, without you having to log in to your banking app each time or manually initiate the transfer.

You retain full control over your agreements at all times, with the ability to view, manage, or cancel the PayTo agreement through your banking app,

Advantage

Real-Time: Similiar to PayID, funds usually arrive instantly or within minutes and unlike PayID, banks generally do not place a hold on first payment under a new PayTo agreement whereas they may do so for an initial PayID transfer to a new recipient*.

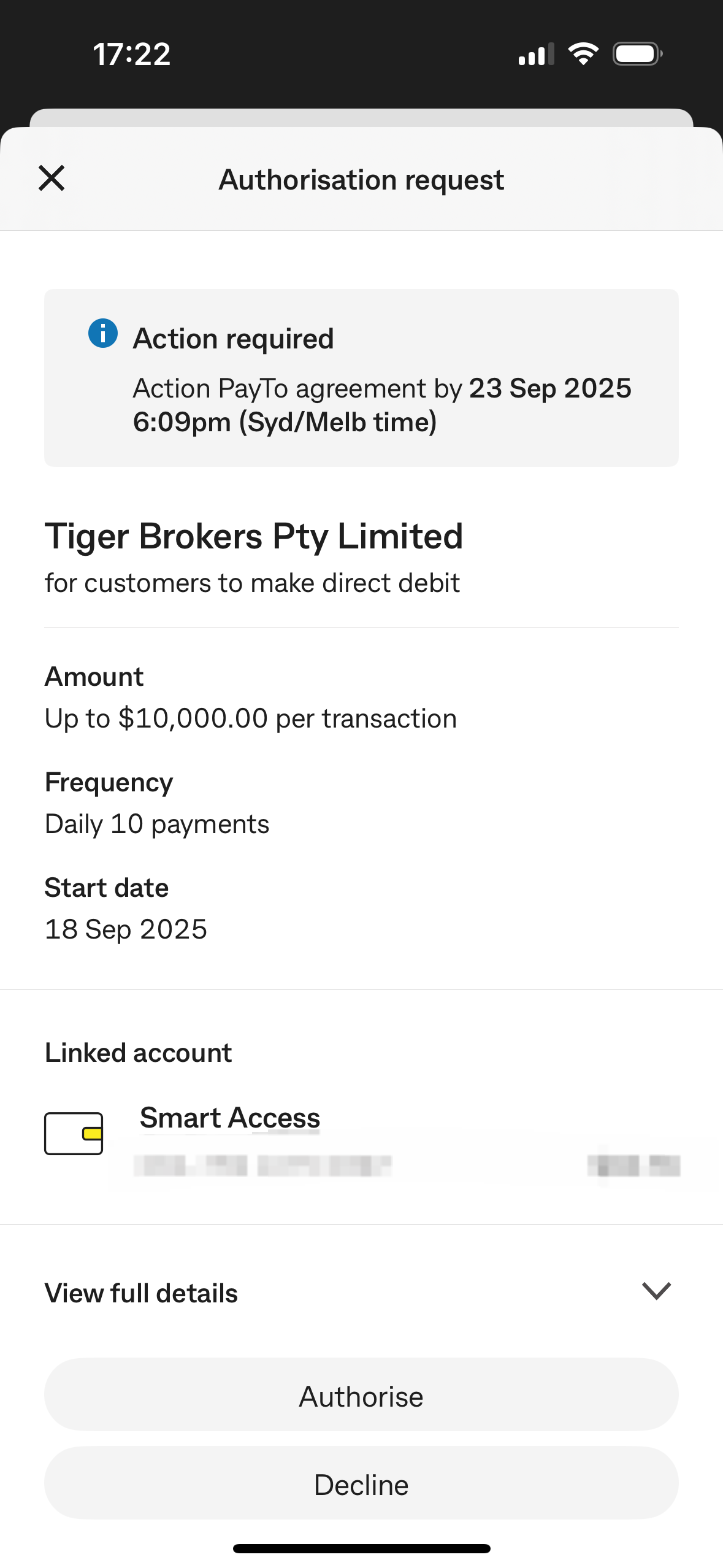

Higher daily deposit limit: Up to 10 PayTo transactions per day, with a maximum of AUD 10,000 per transaction, totalling AUD 100,000 daily per PayTo agreement.^

Convenience: Once setup, you no longer need to login to your bank account and manually enter BSBs, account numbers, or initial PayID transfers. Your deposit will be processed automatically whenever you give the instruction in the Tiger Trade app.

Security: All agreements must be authorised through your bank’s app and deposits can be only made to Tiger Brokers, within the limit and frequency defined in the PayTo Agreement.

Control: You retain complete visibility and control over your PayTo agreements. You can view, manage, or cancel them at anytime through your banking app.

* Payments in some cases may occasionally be delayed for reasons such as additional bank security screening or technical interruptions.

^The PayTo service currently does not support all banks in Australia, and individual banks impose different limits on PayTo deposits. Please follow the prompts to operate.

Why Your PayTo Deposit Might Fail

Agreement not authorised: You have not approved or finalised the PayTo agreement in your banking app or portal.

Insufficient funds: Your nominated bank account does not have enough balance to complete the deposit.

Agreement requests expired: If you do not authorise and approve the PayTo agreement within 15 minutes in your banking app, the authorisation request will lapse, and you will need to try again.

Name mismatch: As with PayID and bank transfers offered by TBAU, deposits are only accepted from bank accounts registered in the same name as your TBAU trading account. If your deposit fails the name verification, the funds will be returned, and you will need to link a new bank account under your name.

PayTo Funding Process

First-Time PayTo Deposit or Adding a New Bank Account

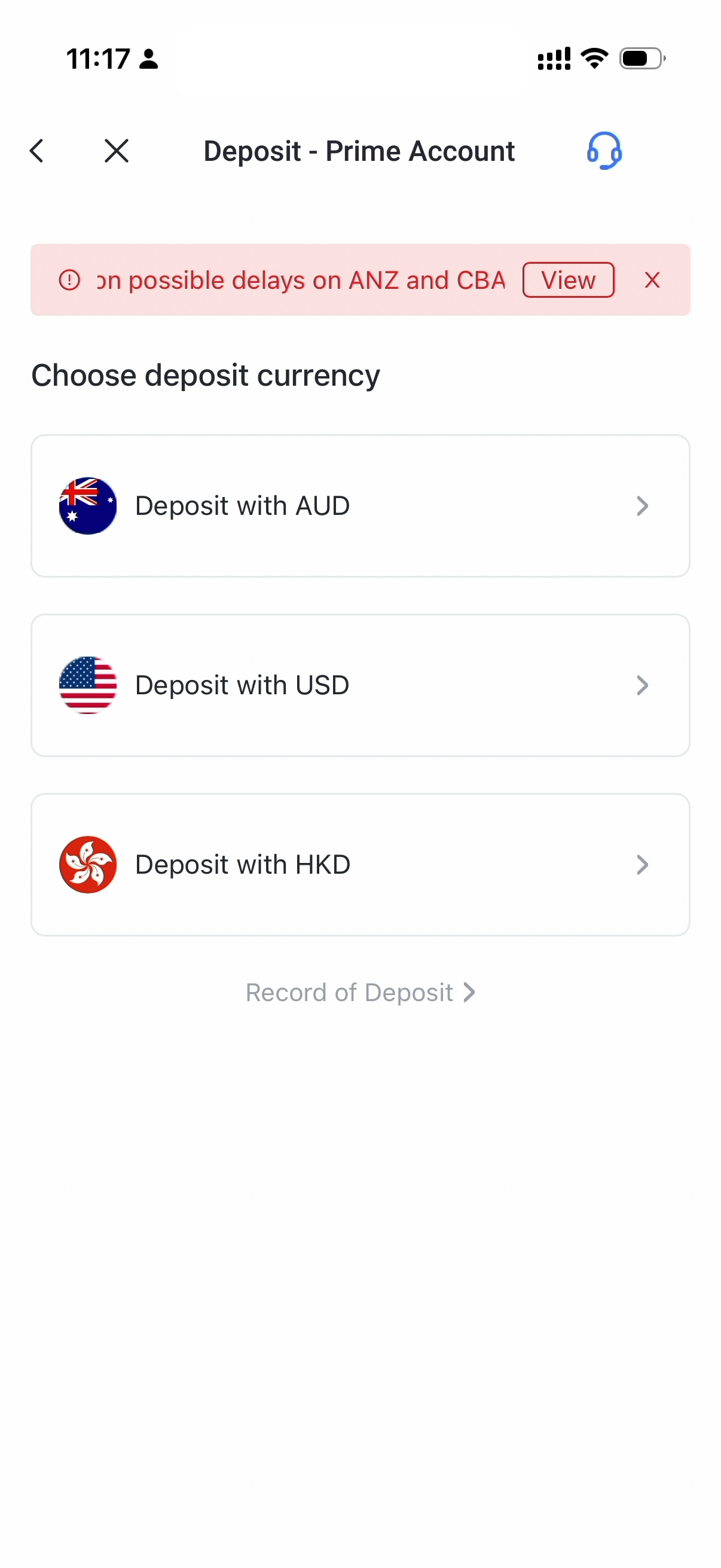

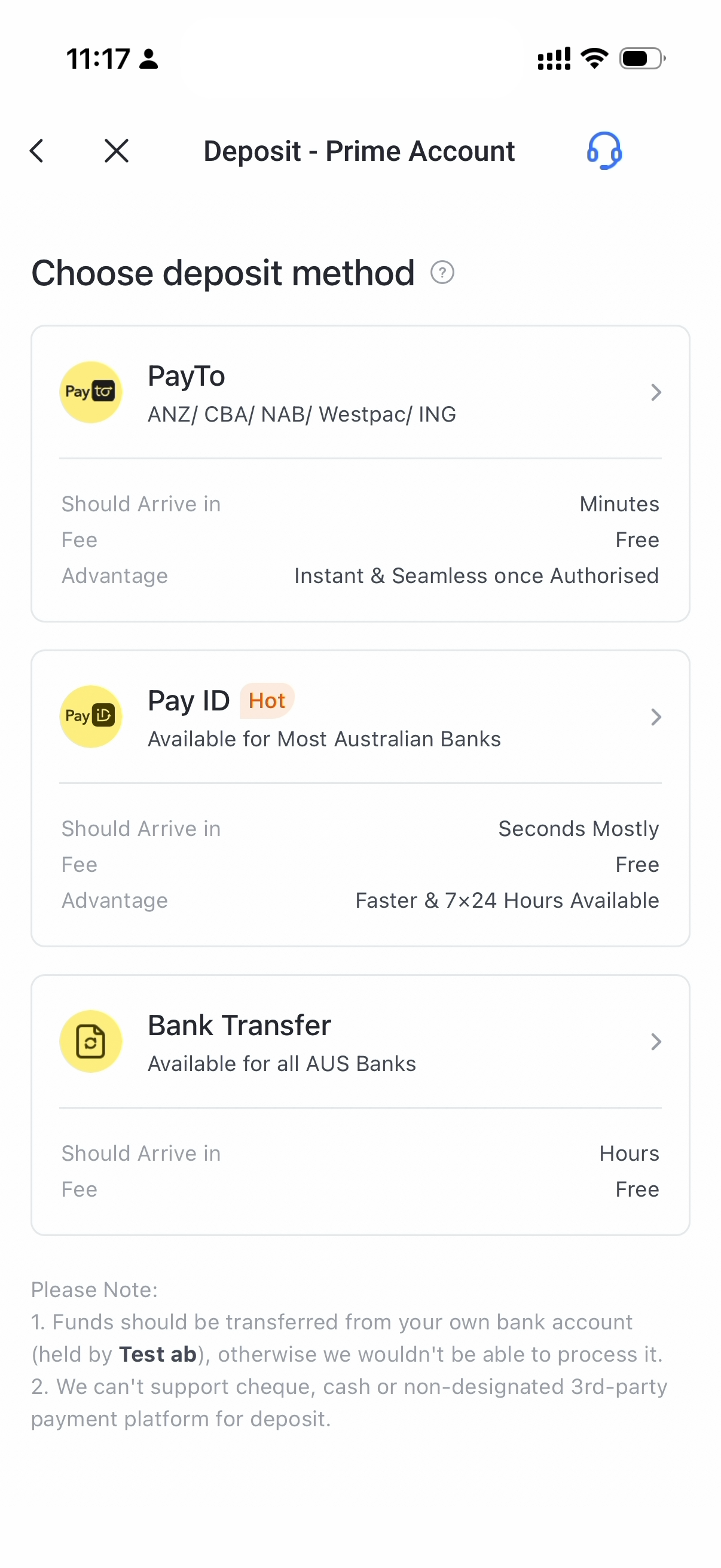

Log in to the Tiger Trade app, then select Deposit → Deposit with AUD → PayTo.

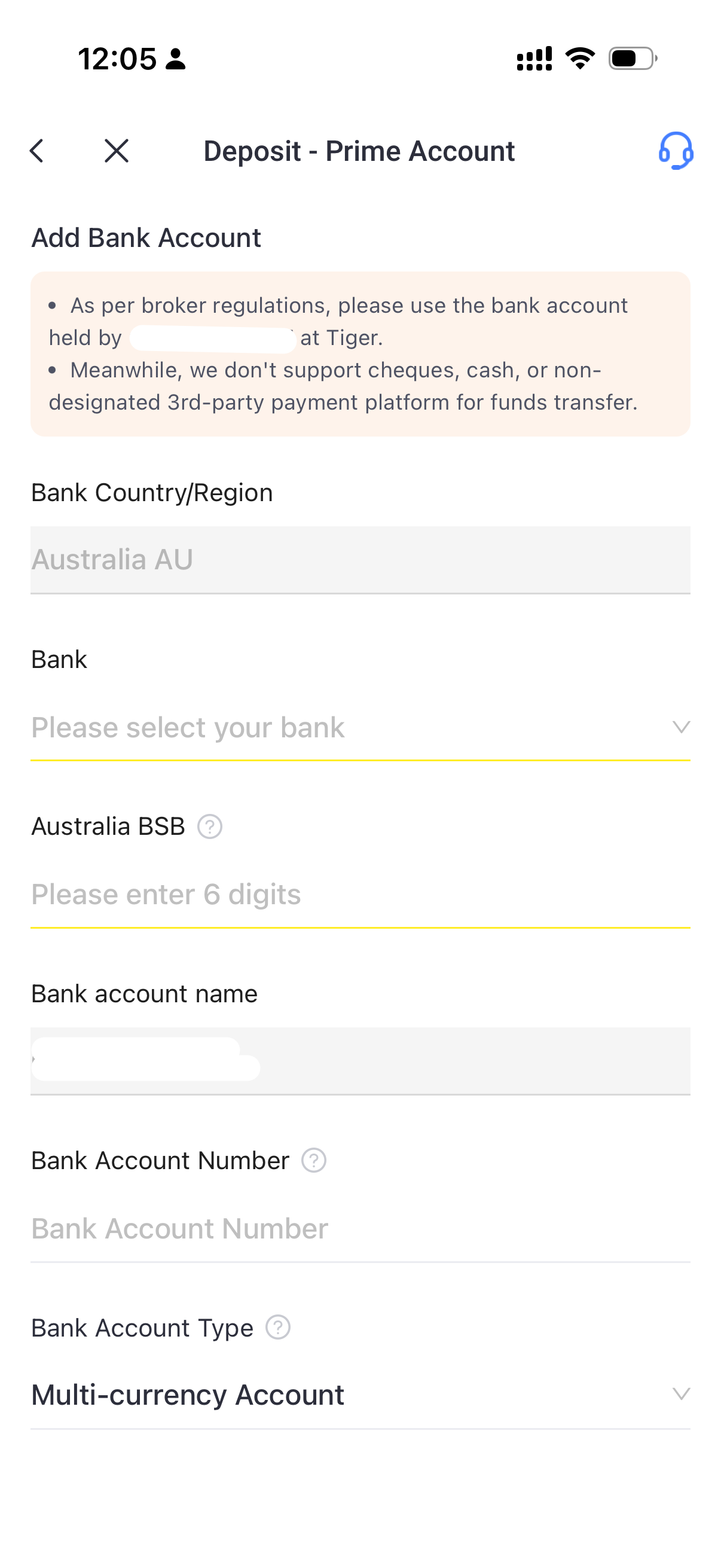

Enter your bank details (bank name, BSB, account number, account holder name) to save the nominated bank account.

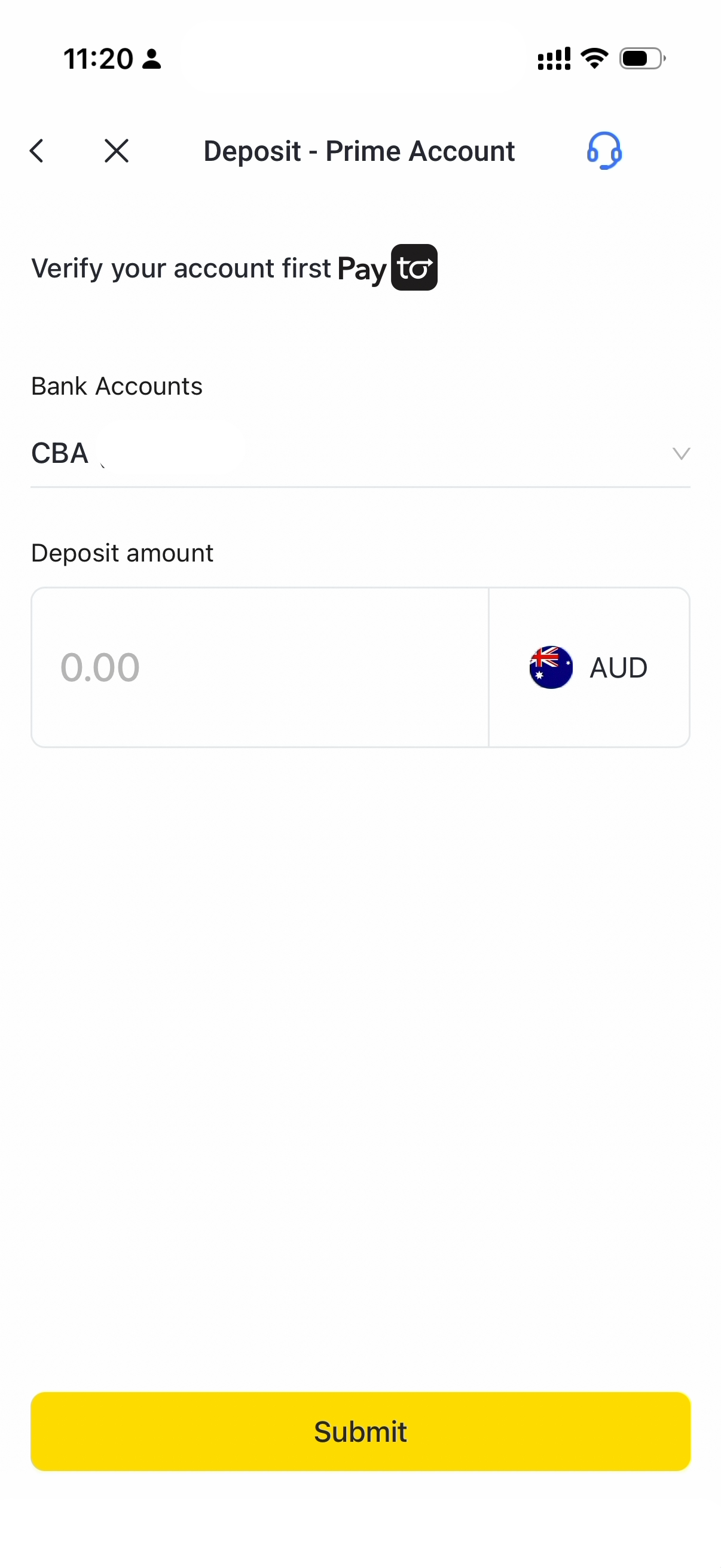

Select the nominated account you saved and enter the deposit amount.

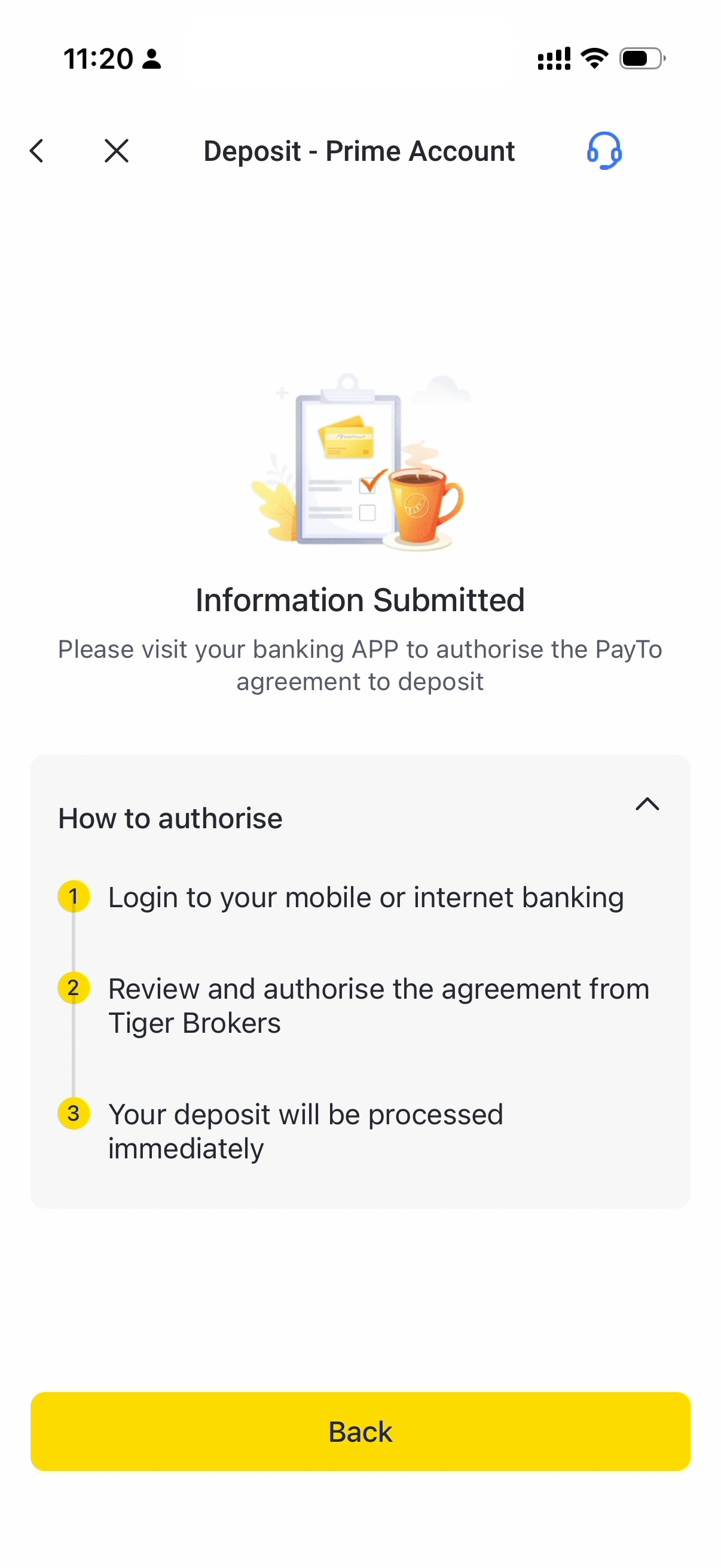

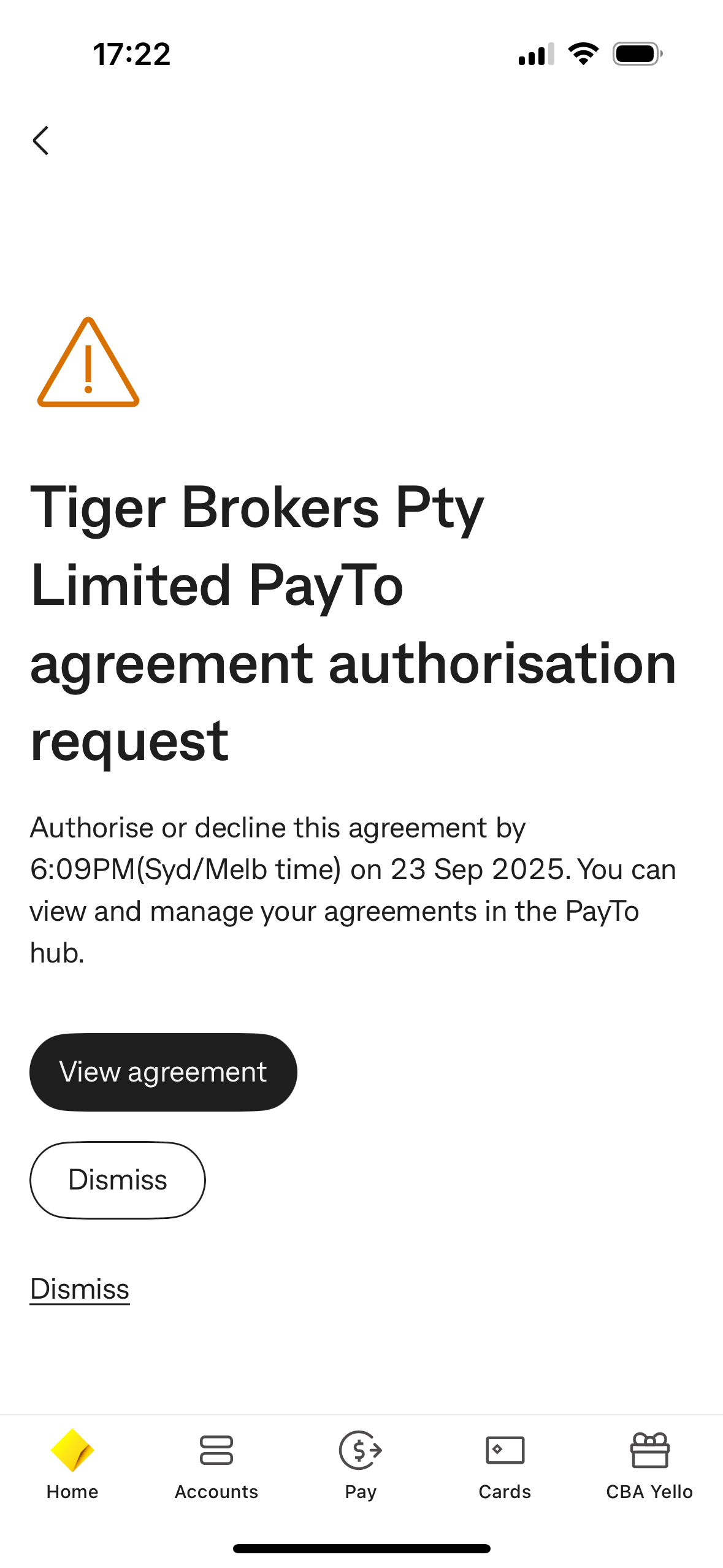

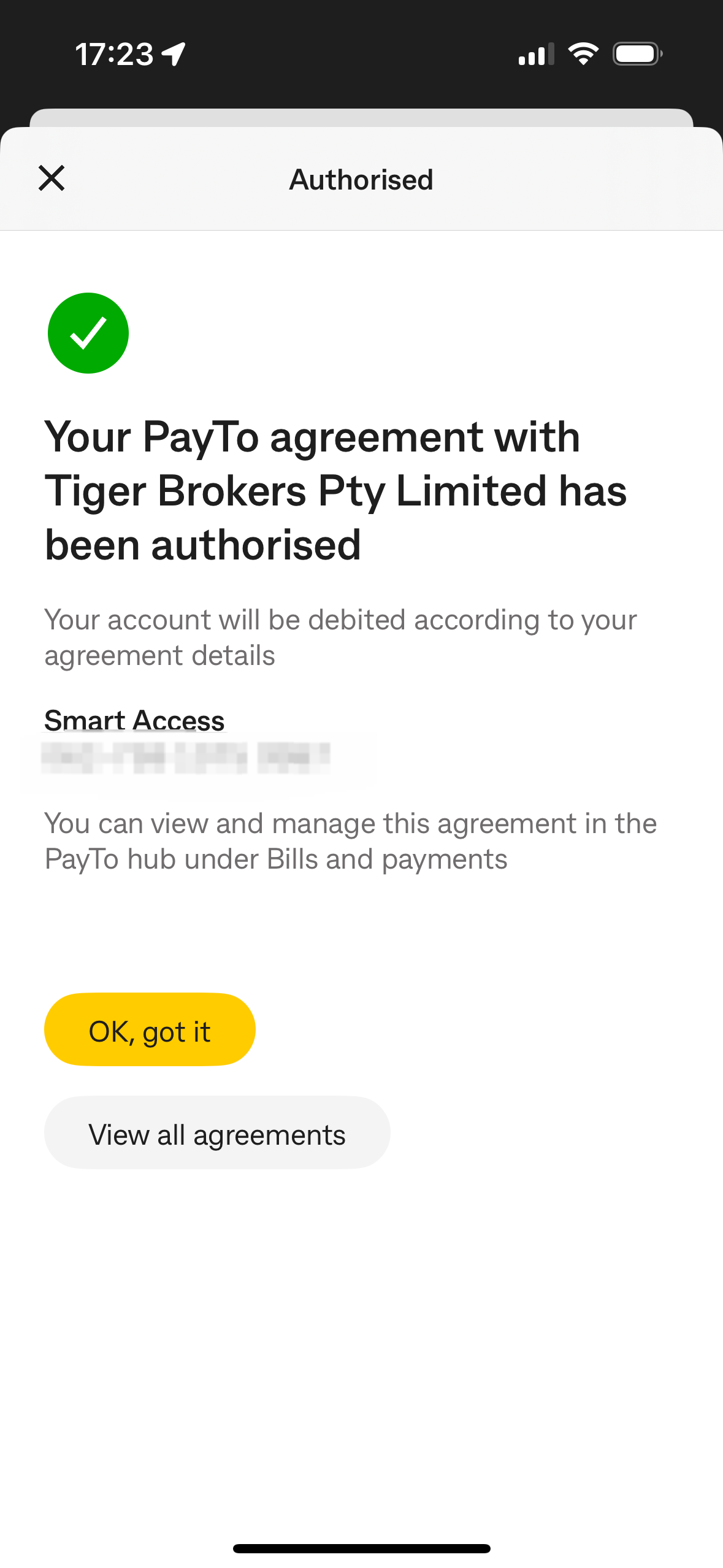

Log in to your banking app or portal.

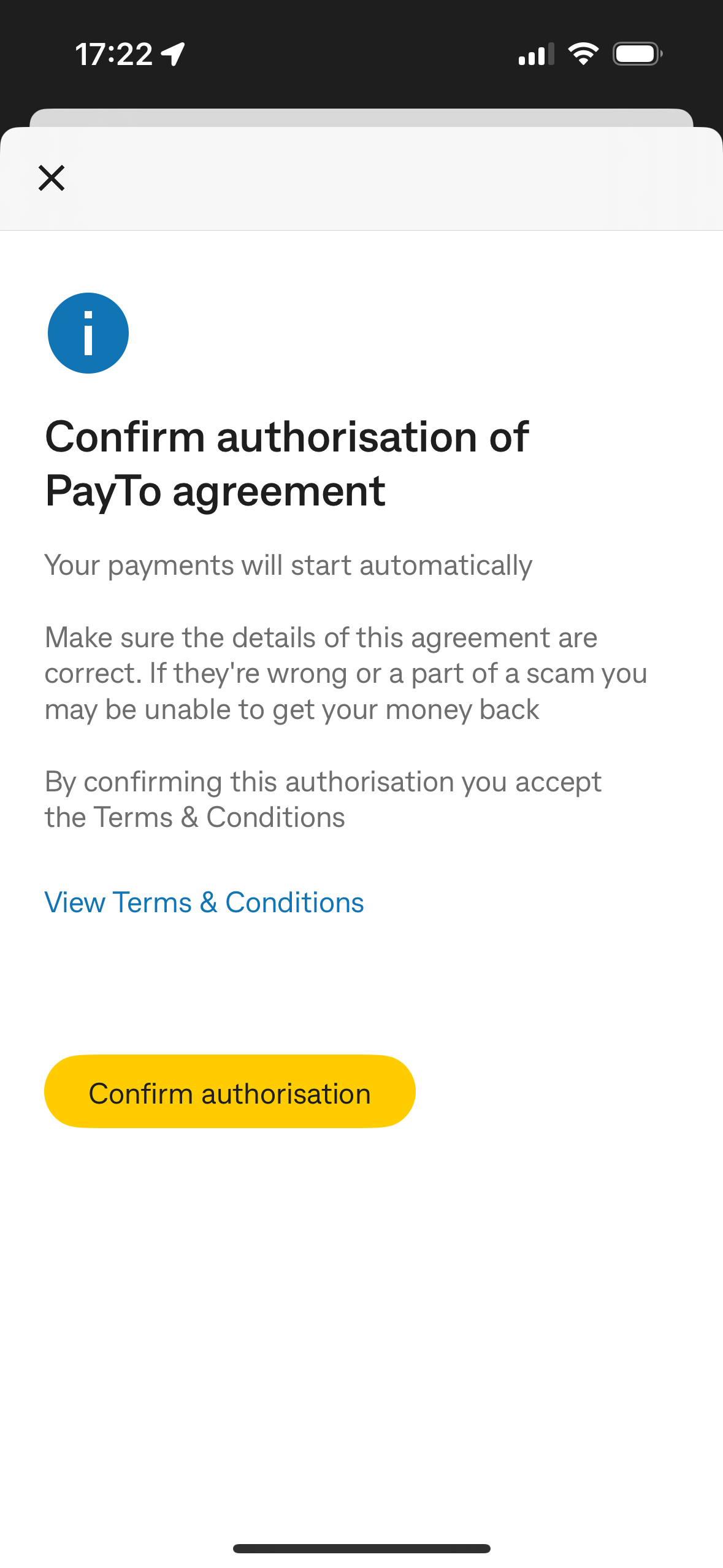

Review and authorise the PayTo agreement with Tiger Brokers within 15 minutes.

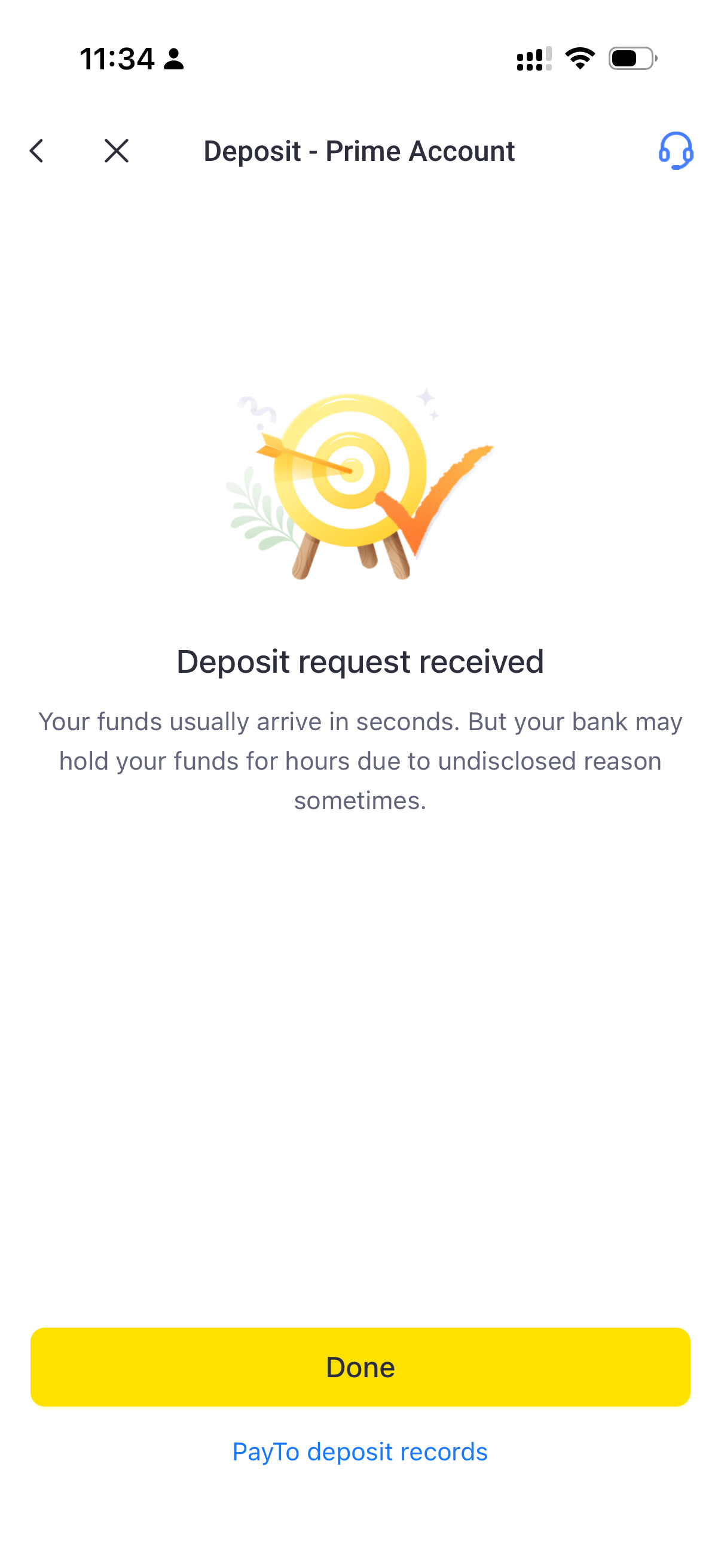

Once authorised, your deposit will be processed immediately.

First-time PayTo Deposit Illustration

Submit an authorisation request in Tiger Trade app

Choose Deposit Currency | Choose Deposit Method | Add Bank Account for First Entry | Enter Deposit Amount in Deposit Page | Submit an Authorisation request |

Authorise PayTo agreement in banking app

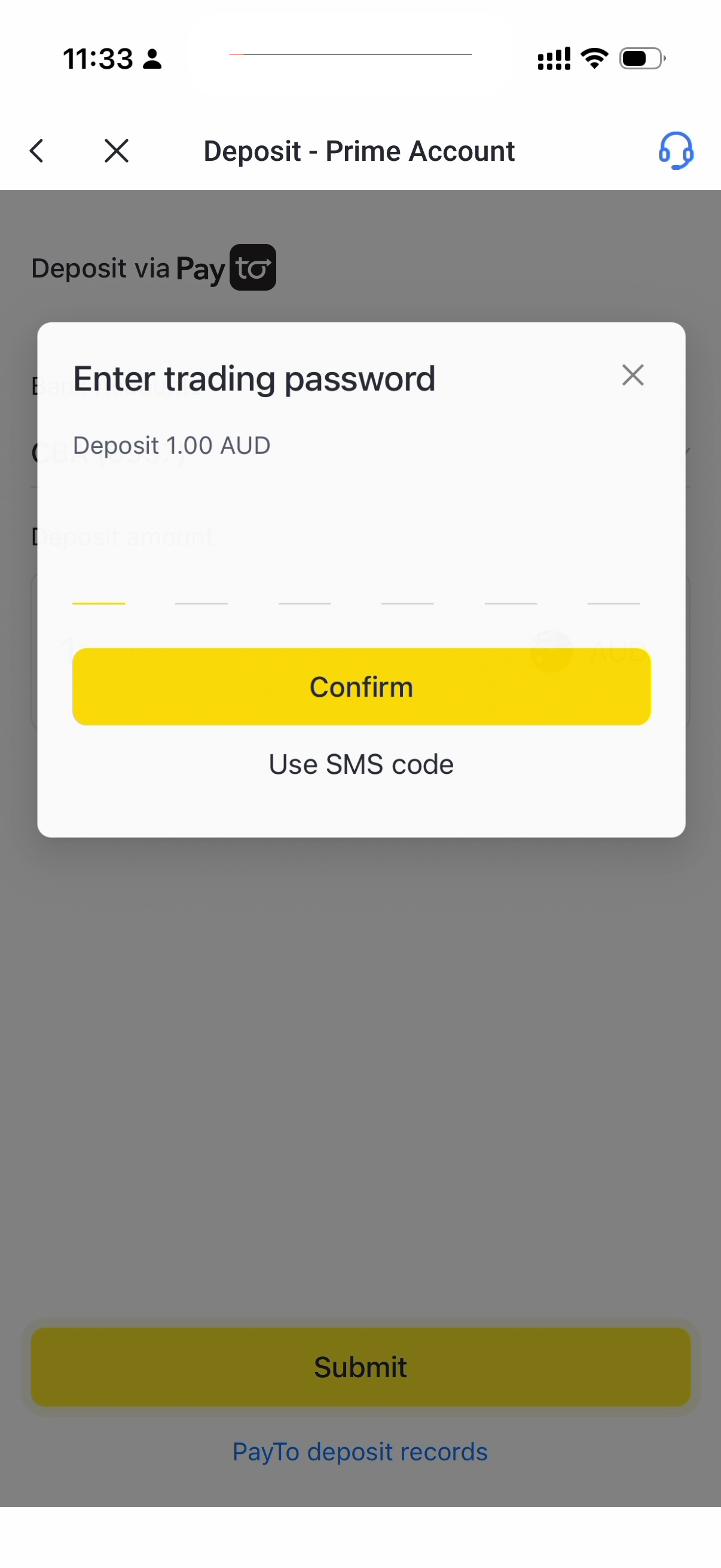

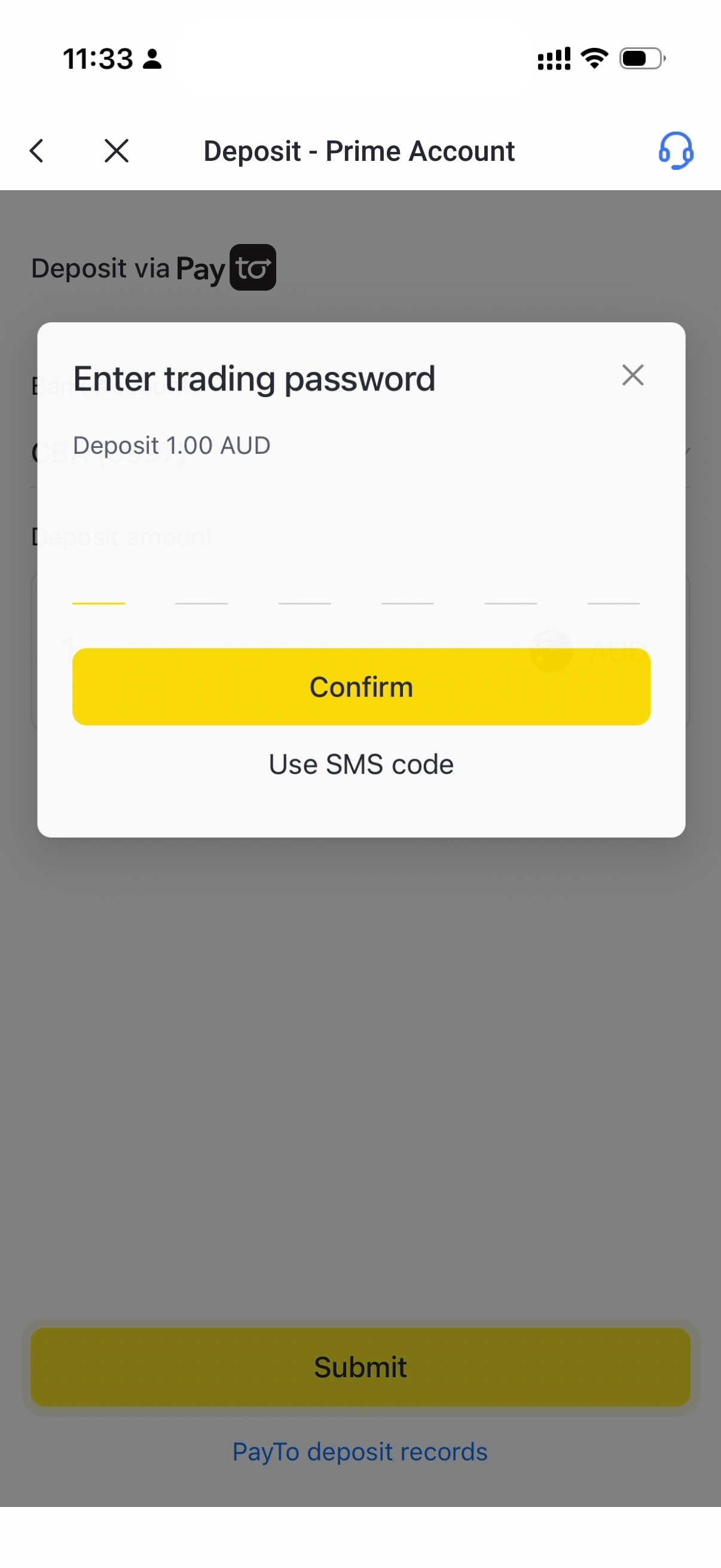

Submit a deposit request

Enter Deposit Amount in Deposit Page | Security Verification | Submit the deposit request |

Using an Existing Nominated Bank Account

Log in to the Tiger Trade app, then select Deposit → Deposit with AUD → PayTo.

Select the nominated account you saved and enter the deposit amount.

Your deposit will be processed immediately.

PayTo Deposit Illustration

In Tiger Trade app

Choose Deposit Currency | Choose Deposit Method | Enter Deposit Amount in Deposit Page | Security Verification | Submit the Deposit Request |